Data released by Eurostat’s earlier on Wednesday showed that Eurozone inflation stayed decidedly flat in August, rising just 0.2 percent in the August month, missing analysts' expectations of a rise to 0.3 percent. The more important core inflation which strips out energy and food slipped for the first time in three months to 0.8 percent from 0.9 percent in July. A separate release showed euro-area unemployment remained unchanged at 10.1 percent.

Today's inflation report follows European Commission survey on Tuesday which showed declines in economic confidence declined across most euro area countries. August inflation figures suggest there is plenty of slack in the Eurozone economy and coupled with unchanged unemployment numbers suggest that wage pressures will remain subdued. The International Monetary Fund has already cut its forecast for euro-area growth next year, and the European Central Bank will release new projections after its meeting next week.

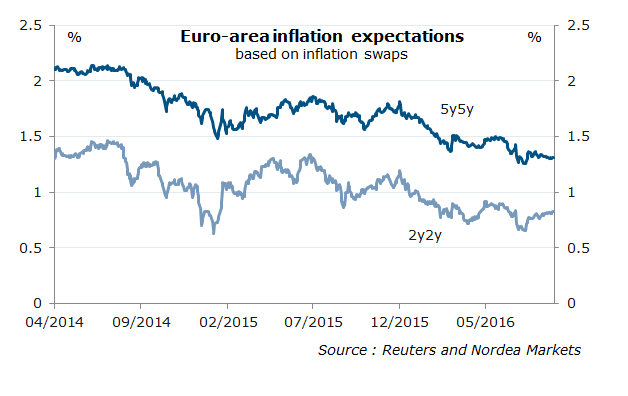

Despite massive stimulus measures from the central bank, which included large-scale asset purchases, negative interest rates and long-term loans that see banks getting paid for extending credit to companies and households, inflation still remains far below the ECB’s goal. The ECB will remain uneasy surrounding inflation trends with the headline rate still substantially below the target rate.

“Today’s data are a small negative surprise and highlight once more the ECB’s difficulties in reaching its goal,” said Holger Sandte, chief European analyst at Nordea Markets in Copenhagen. “It suggests that the ECB isn’t yet done.”

Low inflation rates will inevitably be a key focus at next week’s European Central Bank (ECB) policy meeting. The weaker-than-expected inflation data could mean the ECB is forced to move. That said, while the ECB has indicated that interest rates could possibly go lower, there is clearly heightened concern over the impact that negative/low interest rates are having on Eurozone banks.

"As inflation expectations are still far below the ECB’s 2%-target, we think that the ECB is not done easing monetary policy. Given that policy rates are already so low, the main focus will be on asset purchases. QE for longer, announced, as we see it, in December rather than next week. Later this week, we will publish our ECB preview for the policy meeting on 8 September." Nordea bank said in a report.

There was little immediate market reaction to the data with EUR/USD holding just below 1.1150. The German 10-year bund yields continued to hover between -0.05 percent to -0.10 percent mark Wednesday as markets look to be holding steady ahead of ECB monetary policy meeting scheduled next week.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady