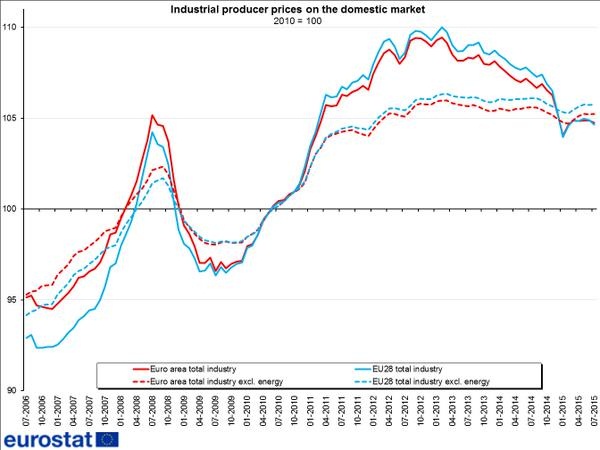

Inflation in Euro zone close to but below 2% (European Central Bank's mandate) will not be easy to achieve in spite of ultra-loose monetary policies from European Central Bank (ECB) purchasing €60 billion assets per month and weaker Euro, as producers benefit from lower commodity prices, especially energy.

Over the past one year oil price has declined more than 60%, which will effectively reduce overall energy costs as well as transportation charges.

- Latest data from Eurostat revealed producer price deflation continued across Euro Zone in July, as prices dropped by -0.1%, down -2.1% from a year ago.

- Latest inflation report showed energy price is being drag of as much as 7%, keeping overall inflation just at 0.2%.

With increased financial market volatility, European Central Bank (ECB) key challenge whether to increase accommodation or choose similar rhetoric of Bank of England to not to chase producer price index.

ECB will hold monetary policy meeting tomorrow at Frankfurt. Euro is currently trading at 1.127 against Dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand