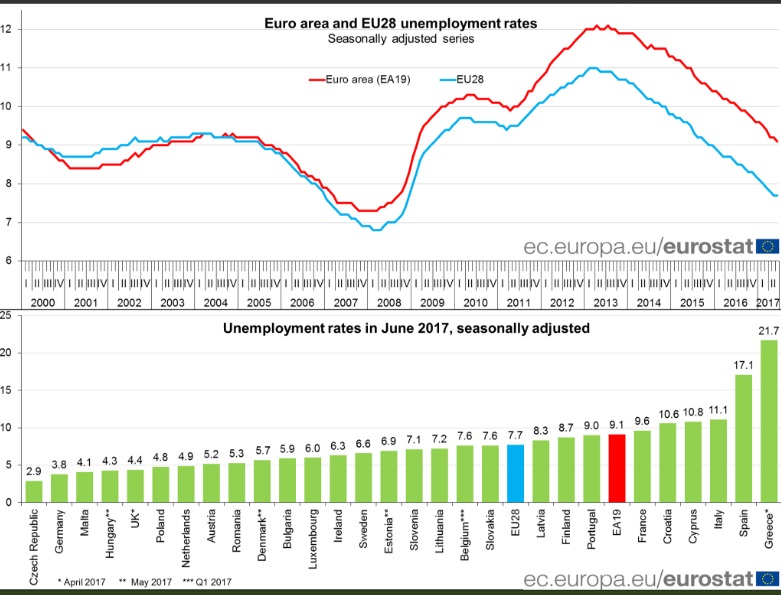

Euro Zone as well as the European Union is facing one of the most diverse economic and Labour market recoveries in the history. Partial reforms pursued by governments coupled with ultra-easy monetary policy from European Central Bank (ECB) have led to the rise in employment across Euro Zone, however, any level that can be called as normal, still remains far off. The latest employment number shows that unemployment declined to 9.1 percent in June, which is the lowest reading since the ‘Great recession’ of 2008/09.

As of now, inflation is weakening again with thanks to lower oil and other commodities price, however if inflation do return before fragmentation is removed ECB would face critical policy choices, weather to raise rates to prevent any overheating of stronger economies with lower unemployment rate or to keep easing to bolster growth across the weaker ones like Greece, Spain, Cyprus. The latest employment number shows that unemployment declined to 9.1 percent in April, which is the lowest reading since December 2008. However detailed country wide number shows continued fragmentation.

European Central Banks (ECB) and the governments need to coordinate together to pursue reforms in such a way that economic recoveries converge and fragmentation gets reduced.

As of latest employment report fragmentation still high, despite improvement in the overall labor market –

- Euro area unemployment rate is at 9.1 percent in April 2017. However, a lot is still to be done as more than 12.5 million still remains unemployed in Euro area.

- Fragmentation is quite large. While Germany enjoys lowest unemployment rate in the region at 3.8 percent, Greece and Spain have their rates at 21.7 percent and at 17.1 percent.

- Even in France, almost every one in ten remains unemployed with the unemployment rate at 9.6 percent.

- Euro area’s third largest economy, Italy is suffering unemployment as high as 11.1 percent and the improvement has been lower than Spain.

- Eight Eurozone countries are suffering higher unemployment rate than the EU average of 7.7 percent.

In recent weeks, ECB has signaled a possible reversal of monetary policies but has been struggling with its monetary policies; record easing and negative rates, still not pushing inflation higher. It’s time the governments do step in to continue with their reforms.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan