Today would be third consecutive week, if US Energy Information Administration's (EIA) weekly inventory shows another drawdown.

- Last week inventory dropped by 2.19 million barrels and market is expecting another drawdown of 2.07 million barrels.

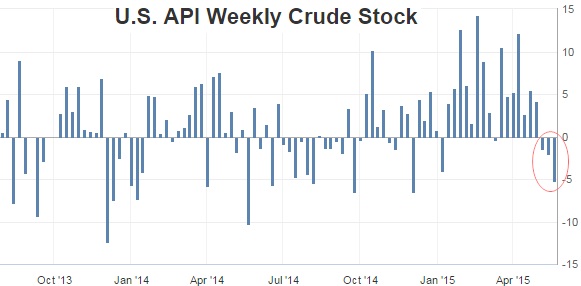

- Like EIA, American Petroleum Institute (API) publishes its own assessment of inventory report, which gets published before EIA report. API report showed larger inventory drawdown by 5 million barrel this week. Chart courtesy Soberlook.

WTI crude is currently trading at $58.6/barrel and Brent is trading at $64.8/barrel.

Larger draw down might push prices upwards, however bears are most likely to remain ready to sell the rallies if Dollar continue to pose strength. Interim support for WTI stands around $55 and $63 for Brent.

As of now, market has shrugged off drawdown, which has not affected the Brent WTI spread. However if larger drawdown becomes persistent then WTI might advance against Brent, narrowing the spread which is currently trading at $6.1/barrel.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?