It seems the tear between the BoJ and the government is getting widening. It is in progress with the BoJ meeting, where the two government representatives urged the BoJ to drop the goal to reach inflation target at the earliest date possible.

We think the BoJ should not focus on introducing further QE which the markets at present broadly expect as do our economists.

The labour market data suggests strength, the company data (new orders) points to improvement in capital investments. The past JPY weakness will support the exports going forward - the lagged effects are at work. Improving current account balance in turn should be positive for the JPY.

And ending with the highlight of the previous few weeks' PM Abe's key economic adviser Hamada stating that USD/JPY would further appropriate on a PPP basis. And indeed the JPY weakening in future seems unlikely. Winds of change retrospectively relative to other currencies as well.

Hence, in coming months we expect Yen getting further strength against dollar.

Derivatives advisory:

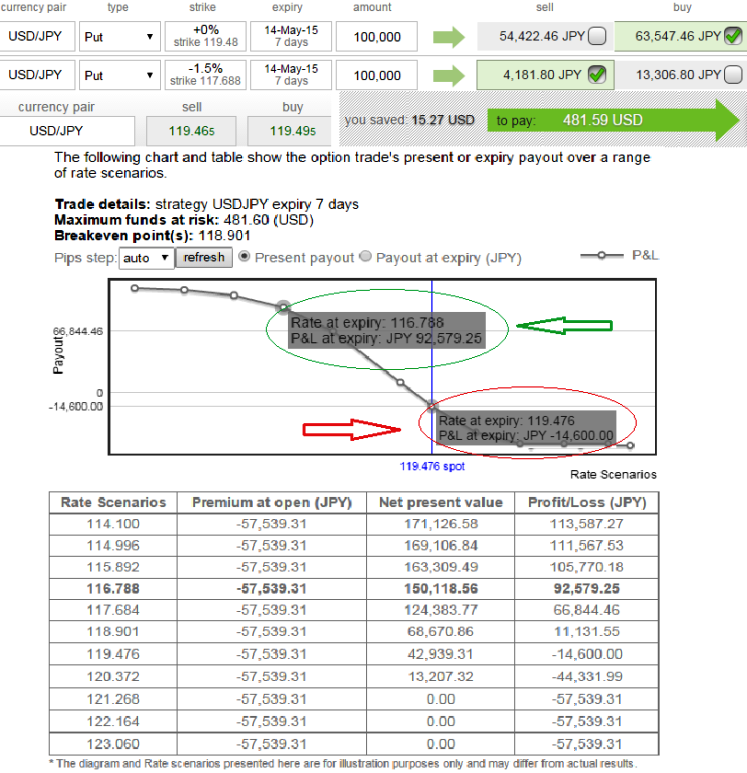

Option strategy: Bear Put Spread (BPS)

It is a partial hedge strategy which only minimizes the loss if the underlying currency has to move lower but does not cap the loss.

Bear Put Spread shall be used over Protective Put when the premiums on Protective Puts are too costlier.

Bear Put Spread = Protective Put + Sell another Put with lower Strike Price (Out of the Money).

Bear Put Spread reduces the cost of hedge by the premium collected on the Out of the money Put but it comes at the expense of Partial hedge rather than a complete hedge.

The above chart explains how this strategy considering in a scenario evidences the different profitability at different intervals of exchange rates.

Expect stronger Yen, BPS safeguards US traders’ cost of hedging

Thursday, May 7, 2015 7:25 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand