When it comes to inflation, we at FxWirePro, aren't much of a dove. In the longer run, we expect all these central bank stimulus will eventually lead to higher inflation. So far, only thing that has been preventing such expectations to realization is lower oil price. If oil price would have remained at level of 2014 or even a bit lower say, 30%, US would have achieved much anticipated 2% inflation goal.

Inflation is what we are most worried of. Probably more than China. Global rise in inflation could very much lead to a policy windup, sufficient to create all the turmoil and it would be enough of a spark to trigger debt crisis in China.

While some might point out to lower growth, history is well documented with periods of lower growth and higher inflation, even have a term for it, 'Stagflation'.

Some measures are really giving us some worries -

- Gold has risen sharply in recent days. Close to 20% from its bottom around $1050/troy ounce.

- Copper, which is considered as barometer for global growth has jumped up 16% from its bottom and that is despite weaker growth.

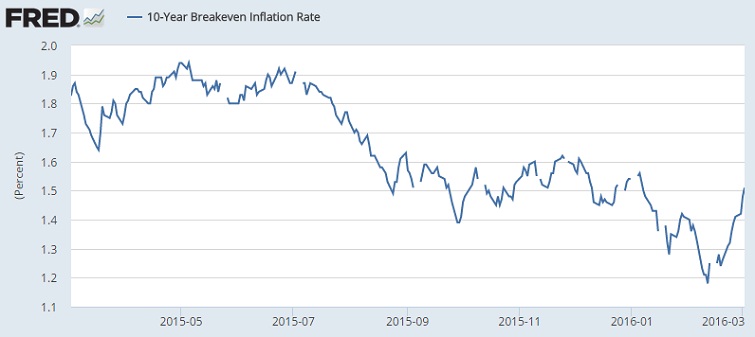

- Another measure inflation expectation, has picked up sharply recently. After bottoming to 1.18%, US 10 year breakeven inflation rate has jumped close to 30% and currently hovering around 1.55%.

These developments are just due to weakness in Dollar or greater shift in inflation trend is yet to be confirmed but these are definitely making us worried of our longer run expectation.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated