The U.S. Federal Reserve kept interest rates unchanged on Wednesday and explicitly referred to the "next meeting" when discussing the appropriate time horizon to raise rates. The direct reference puts a December rate hike firmly in play. The central bank also downplayed recent global financial market turmoil which was the main reason for policy makers to refrain from a hike in September. However, the global economy remains on the Fed's radar as it kept the hint that it is "monitoring developments abroad".

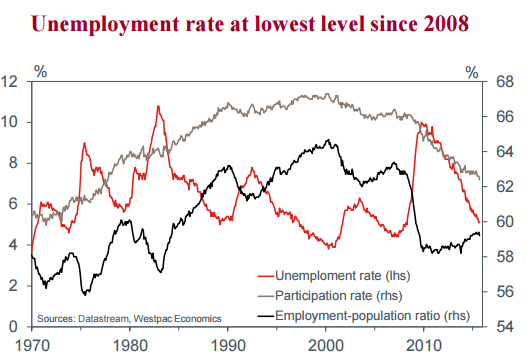

The overall pace of the economic expansion in the US is described "moderate", as before. The Fed said the U.S. labor market was still healing despite a slower pace of job growth. The Committee anticipates inflation to remain near its recent low level in the near term but expects a gradually rise towards 2 percent over the medium term as wage growth finally begins to pick up and the transitory effects of declines in energy and import prices dissipate.

"No changes on the other main worry, low inflation: transitory downward pressure from low energy prices and the strong dollar is likely to hold down inflation near term, but inflation should pick up towards target in line with a better labor market over the medium-term", notes Commerzbank in a research report.

In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. Two employment reports will come out before the December meeting on Nov 6 and Dec 4 and two readings of the Fed's preferred inflation measure, the price index for personal consumption expenditures ex food and energy (Oct 29, Nov 25).

A stabilization of international financial markets coupled with relatively robust US economic data should provide clear arguments for a first rate hike in December. That said, in light of the Fed's track record of holding off when in doubt the possibility of a later-off cannot be ignored.

US advance GDP estimate due today will gather much attention. While a subtrend growth will excite the doves, this would be largely due to an inventory adjustment that the FOMC should normally look through. In any case the Fed's September projection of 2.1% real GDP growth in 2015 (Q4 versus Q4 2014) looks well achievable, even if Q3 comes in well below 2%.

USD spiked across the board following the FOMC statement which was clearly a victory for the hawks. USD/JPY spiked to 121.26, while EUR/USD hit 1.0897 lows post FOMC yesterday. On Thursday, Yen staged a solid comeback, and USD/JPY has pared most of the gains to trade at 120.76 at 1000 GMT.

FOMC keeps December hike still alive

Thursday, October 29, 2015 11:13 AM UTC

Editor's Picks

- Market Data

Most Popular

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks