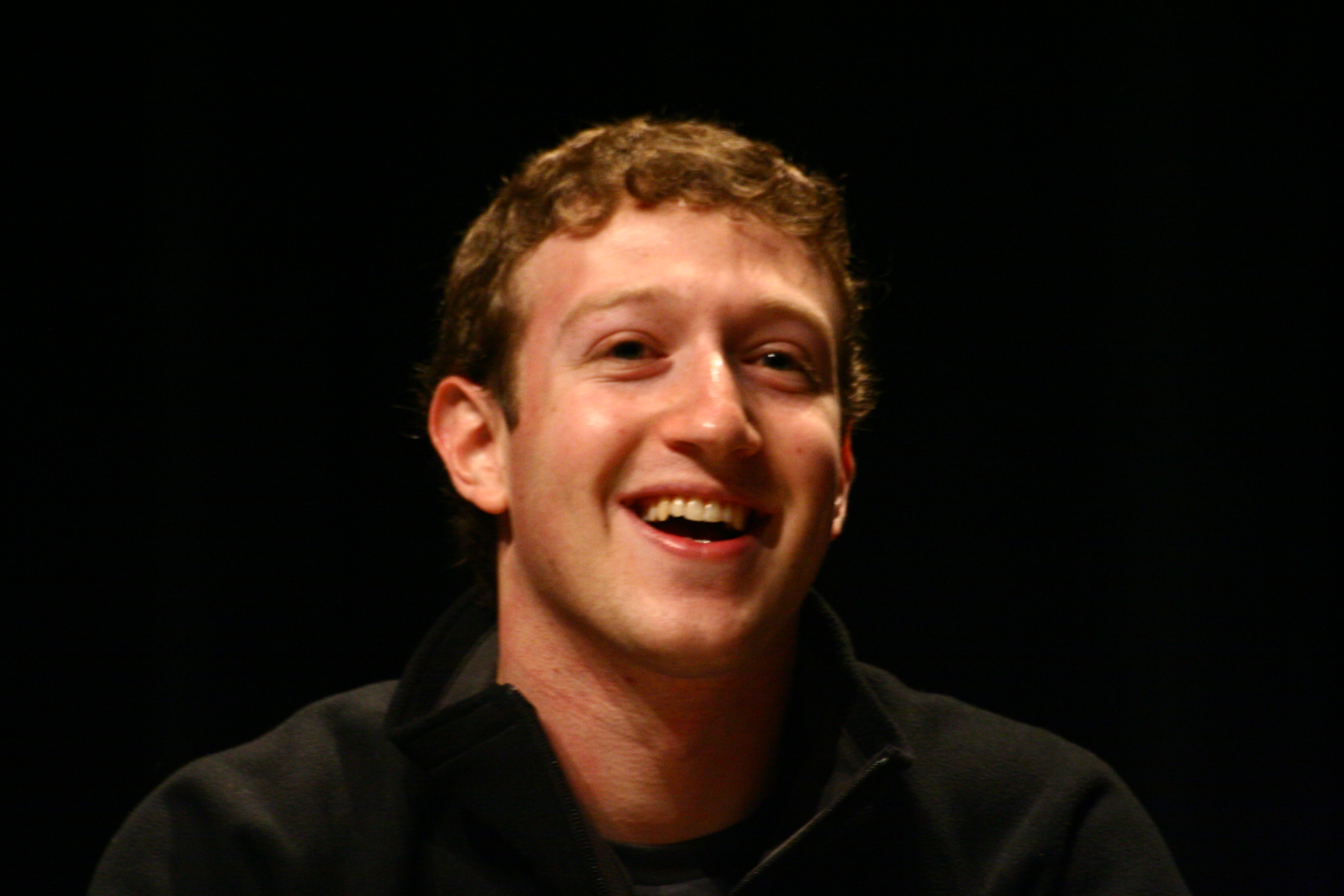

Mark Zuckerberg is often heard proudly crowing about Facebook’s commitment to free speech, but many would agree that there is a limit. For example, pornographic content and posts encouraging drug abuse should be excellent candidates for being banned from the platform. Yet it took the social network only now to actually start doing it, demonetizing all contents involving porn, drugs, hate, and violence.

Posting some new rules that it will be imposing on content creators from now on, Facebook outlined what it expects from the people that are going to be putting videos, articles, photos, and more on its platform. The post also has a notable emphasis on being as advertiser friendly as possible, thereby emulating Google’s policies.

“To use any of our monetization features, you must comply with Facebook’s policies and terms, including our Community Standards, Payment Terms, and Page Terms. Our goal is support creators and publishers who are enriching our community. Those creators and publishers who are violating our policies regarding intellectual property, authenticity, and user safety, or are engaging in fraudulent business practices, may be ineligible to monetize using our features,” the post reads.

Many are also taking the move to be Facebook’s way of earning back the trust of marketers, who seem to be under the impression that the social media site is not as transparent and as responsible as it should be. Ad Week asks the question as to whether or not it’s far too late for that.

For example, there was that recent revelation that Russian entities actually paid Facebook $100,000 to run anti-Hillary Clinton and pro-Donald Trump ads back during the 2016 presidential election. It would be rather difficult to come back from that, especially considering just how sensitive the issue is right now in the US. Making moves on inappropriate content is a good move, but it’s one that Facebook should have arguably done long before now.

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence