The dollar has indeed rallied on Fed rate hike expectations, and has been on uptrend since mid-2014. The trade-weighted DXY index has seen a rise of around 27% in the past 16 months. With support from attractive growth and shifting interest rate differentials vs major peer currencies, U.S. dollar strength is poised to continue.

"Broad USD strength is expected into year-end, and policy-driven FX divergence is seen taking place through 2016. Most major currencies are expected to stabilize in 2016, with the exception of continued weakness for both the euro (EUR) and the Japanese yen (JPY)", notes Scotiabank in e research note to its clients.

Overnight Index Swap (OIS) contracts are implying a 30% chance of a September hike, and over a 90% chance of one hike in 2015. USD is exepeted to rally in a hike scenario, even in the case of a "dovish hike".

Fed is unlikely to determine the direction of the dollar in the coming months. Some basic analysis into historical data suggests that the dollar is not that closely related to the Fed's rate hiking cycles. The dollar movements at previous hiking cycles in 1987, 1994, 1999, and 2004 are as follows :

1987: USD fell in the first few months of hikes.

1994: Dollar drifted sideways, before embarking on a mild upward trend.

1999: Dollar continued with its mild uptrend, which had started before the Fed began raising interest rates.

2004: The dollar fell as the Fed embarked on a rate hiking cycle.

USD typically appreciates the 3-6 months into the first hike and then depreciates after hikes begin as other central banks follow suit. With the exception of the BoE, most G10 central banks will be on hold or easing so the rate differential offset will not be there this time around. But, assuming risk sentiment holds up, policy divergence will be a key driver for price action in USD crosses.

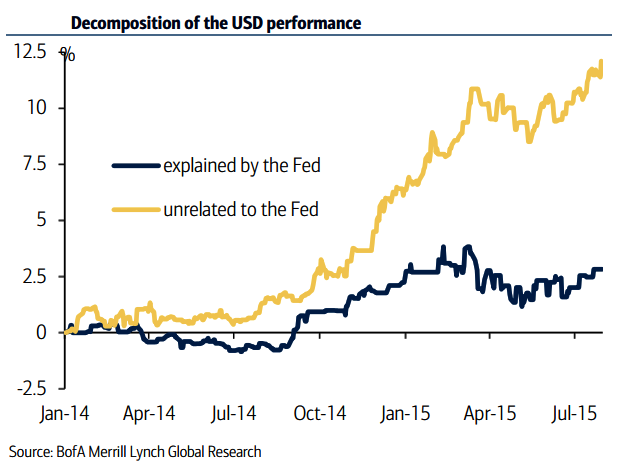

The immediate reaction of the dollar to Fed hikes will be a function of several factors: (i) risk sentiment, (ii) pace of hikes going forward, and (iii) China. Most of the dollar's recent moves are due to "growth shocks," likely related to slowing Chinese growth and/or ECB QE, not shifting Fed policy expectations.

"We favor EUR shorts with the ECB recently paving the way for QE expansion later this year, more broadly, despite the 15% trade-weighted dollar appreciation since end-June 2014, we still expect the USD to rise further once the Fed starts to hike", says BoFA Merrill Lynch in a report to its clients.

The dollar climbed against a basket of currencies on Wednesday, strengthened by rising U.S. yields. The dollar index was up at 95.659, off a two-week low struck on Monday. The euro was down 0.15 percent at $1.1252, while the dollar was flat against the yen at 120.39 yen.

Fed unlikely to determine USD direction in the coming months

Wednesday, September 16, 2015 10:52 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand