Growth in French services sector weakened during the month of October, pointing to a modest rate of growth during the period, the slowest in three months. Concurrently, input cost inflation eased slightly, while average selling prices continued to decline at a solid pace. Business expectations remained positive during the month.

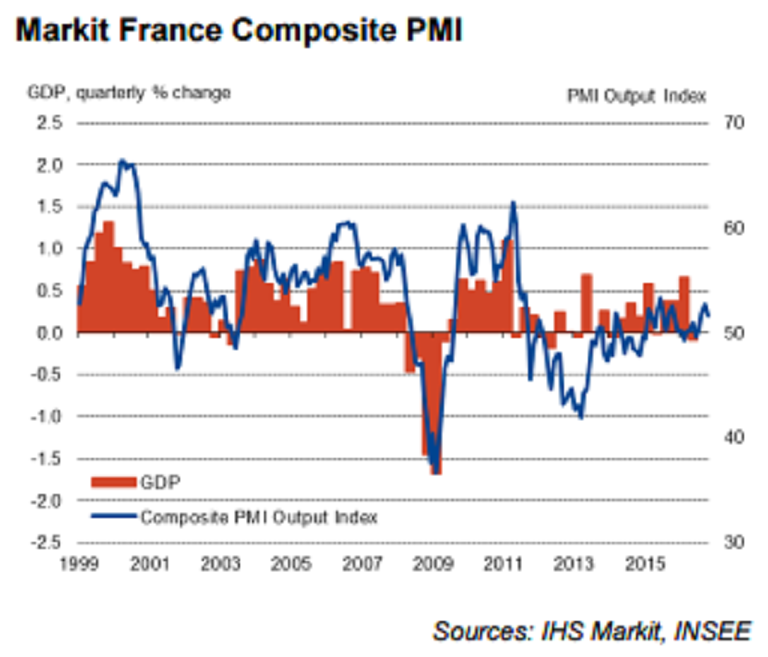

The seasonally adjusted headline Markit France Business Activity Index posted 51.4 in October. Down from 53.3 in September, the latest index reading pointed to a modest rate of growth that was the slowest in three months. Further, the final seasonally adjusted Markit France Composite Output Index, which covers the combined manufacturing and service sectors fell to 51.6 in October from 52.7 in September, and signalled the lowest rate of growth in three months.

The rise in new orders contributed to an eighth successive monthly expansion in the level of outstanding business during October. Moreover, the rate of backlog accumulation accelerated from September to the sharpest recorded in 16 months.

Meanwhile, input prices facing companies operating in the French service sector rose for the eighty- second consecutive month in October, amid reports of rising employment costs. The rate of cost inflation remained modest and broadly in line with last month’s trend. At the composite level, input prices rose again in October and at the sharpest rate in five months.

"Business expectations remained strong, suggesting companies are hopeful conditions will continue to improve in the months ahead," said Alex Gill, Economist, IHS Markit.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals