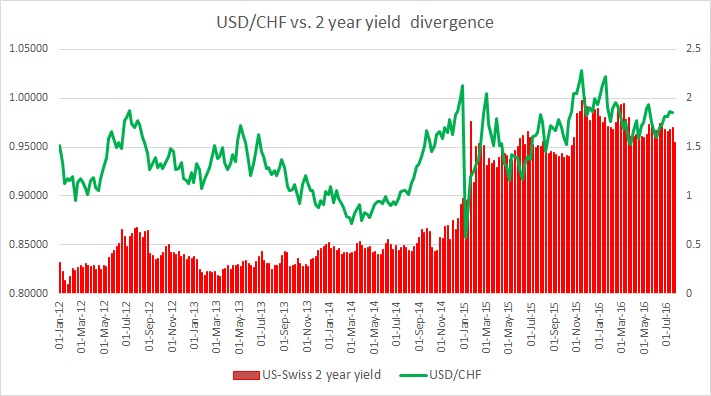

In recent days, Swiss franc’s correlation with the 2-year yield spread (US-Swiss 2 year) has dropped to 25 percent but time on time again it shows relatively high positive correlation, as high as 80 percent at times. Just before and after the Brexit referendum in the UK, the 20-day rolling correlation was averaging above 60. Hence, it is vital to keep a watch on the Swiss yields.

Just after the Swiss floor shock in January 2015 when the Swiss National Bank (SNB) removed a floor in EUR/CHF at 1.20 this relation went to negative and stayed there until October with occasional bounces to positive territory. It hasn’t gone to the negative since and was closely related to the yield (above 80 percent) in January this year.

Unlike the euro or the pound, the Swiss franc is considered a safe haven, hence the yield relation sometimes gets overlooked.

However, Swiss yields are a must watch as they are the lowest for any government bonds in the world and any shift in that will mark a major turnaround in trend. The above chart explains how the relation between the spread and exchange rate has unfolded since 2012.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022