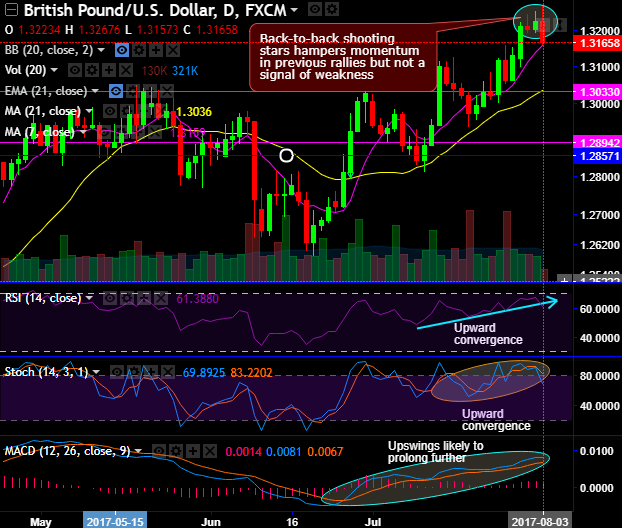

GBPUSD bulls in consolidation phase seem to be exhausted after the formation of back to back shooting star candles from last three days (daily charts), at 1.3203, 1.3223 and today’s bearish candle with the big real body again indicates weakness.

Well, these bearish patterns are not to be isolated and perceived as a signal of bearish risks, instead, likely to hamper the ongoing bullish trend in the consolidation phase. Hereafter, swings may go either in sideways or minor corrections but unwise to expect steep slumps.

Both leading oscillators seem to be in bulls’ favor, RSI constantly evidences upward convergence to signal the strength in bullish rallies. While stochastic curves have also been indicating intensified momentum but slightly indecisive on daily terms as it reaches overbought zone but certainly not in bears’ favor.

On the other hand, lagging oscillators are also in sync with the same bearish stance offered by the leading indicators. MACD indicates the price rallies to prolong further on both time frames, while the current prices on daily terms remain well beyond 7DMA but on monthly terms every attempts of upswings were restrained below 21EMA.

Hence, on the broader perspectives, the consolidation phase remains intact upto 1.3393 (i.e.21EMA), while interim rallies seem to be slightly edgy as the above mentioned bearish patterns likely to hamper the bullish momentum as BoE maintains status quo in its monetary policy announcement. Bank of England’s (BoE) rate cut almost exactly one year ago a policy error. The British central bank has left policy unchanged to leave bank rates at 0.25%.

Well, the overall minor trend may go little weaker in worst case scenario, while the sterling is surging for a 9th consecutive session against the US dollar, staying well beyond 1.32.

While the FxWirePro currency strength index for the sterling indicates bullish attributes as it flashes +42 (which is bullish) as BoE stays pat, while USD has been mildly bullish by flashing +29 (while articulating) for the day eyeing on some sort of cushion from today’s BoE bank rates and unemployment data from the US side.

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

Trade tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads for the day which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 1.3223 and lower strikes at 1.3158 levels.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  GBPJPY Roars Back 100 Pips — Bulls in Charge Above 210

GBPJPY Roars Back 100 Pips — Bulls in Charge Above 210  FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Major European Indices

Major European Indices  EUR/JPY Stuck in Neutral Gear — Bulls Still in Control Above 182

EUR/JPY Stuck in Neutral Gear — Bulls Still in Control Above 182  FxWirePro: AUD/USD jumps after RBA rate hike

FxWirePro: AUD/USD jumps after RBA rate hike  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls

AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls  FxWirePro: GBP/NZD outlook weaker on renewed downside pressure

FxWirePro: GBP/NZD outlook weaker on renewed downside pressure  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns