The dollar is under pressure as month-end rebalancing is expected to see USD selling. However, US 10-year real yields continue to fall into record lows, which is also weighing on the USD.

Today’s focus is squarely on the result of the two-day FOMC meeting. The Fed left monetary policy unchanged in June but Chairman Powell emphasised that they would take further action if necessary. The chorus of warnings from Fed policymakers earlier this month warning about the resurgence of Covid-19 damaging the economic recovery suggests a clear bias to further action from the Fed, there has been 2nd wave of pandemic in many regions of the world.

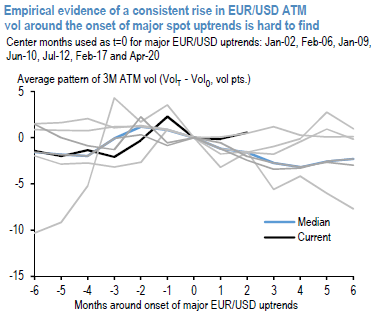

The Euro breakout over the past week has created a frisson of excitement in FX option markets. Ever since the “synchronized global growth” frenzy of 2H'17-1Q'18 was rudely cut interrupted by the US-China trade conflict and the associated upheaval in emerging markets, FX options have oscillated between two binary regimes – either the pincer grip of sluggish momentum and tight spot ranges, especially in EUR and JPY, reinforced by systematic and/or structured vol supply, or abrupt deleveraging triggered by unpredictable left tail events (tariffs, virus). Neither are particularly conducive to classical macro investing that relies on slow moving trends to put capital to work, which is why there is now palpable enthusiasm around the possibility of an extended runway for dollar weakness and the potential for meaningful FX alpha for the first time in more than two years.

From an FX vol perspective, it is material that the cue for such weak-dollar excitement was provided by the Euro and not any of the smaller G10 currencies. With all due respect to the latter, only trends in EUR and JPY – the two currencies that boast the deepest, most liquid option markets – offer the realistic possibility of option premium investment on a scale that can move the needle on large fund returns and re-shape vol surfaces on a sustained, multi-month basis due to the sheer quantum of option demand, even when the direction of the spot move runs counter to traditional spot-vol correlation. The two most recent cases in point are the Abenomics/BoJ QQE inspired USDJPY rally from 3Q’12 – 2Q’13 worth 60% on spot and 10 pts.

On 3M ATM vol trough-to-peak, and the comparatively much tamer 20% rally in EURUSD that lifted 3M ATM vol 2 pts; in both cases, risk-reversals were forced to flip signs as the longstanding inverse link between spot and vol was upended by massive macro buying of USDJPY and EURUSD calls. Courtesy: JPM

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic