The dramatic equity market plunge on Thursday, the sentiment gyrations amid heightened uncertainty around COVID-19, oil and the state of global economics have broken the markets and left a number of dislocations in FX vol space. Challenging liquidity stands in the way.

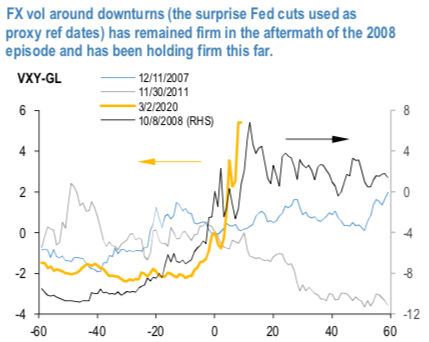

Fx vols around the similarly challenging past episodes (proxy with surprise Fed cuts) look mixed (refer 1stchart). Namely, FX vols remained firm in the aftermath of the 2008 episode, declined in 2011 and have been holding firm following the last week’s cut. It would be a stretch to compare magnitude of the ongoing vol episode with the one from 2008, but we do expect to see similarly persistent tail vol profile. Until a more robust policy and government response to COVID-19 the economic and political uncertainty are in the cards and keep us defensive for longer.

Long yen 3m3m fwd vols 2-sigma value

Amid the souring sentiment in conjunction with the rapid spread of COVID-19 to the western economies and the oil kerfuffle, a number of FX vol surfaces got twisted to a degree not seen in more than a decade, JPY vols and x-vols particularly so. The jump in gamma pricing and the consequent sharp curve inversion (1.5vol of inversion on 1M-2M segment for VXY-GL) has seen the bulk of the FX universe fwd vols in buy territory (refer 2nd chart), if compared with spot vols. Flip/flopping FX gamma makes liquidity and pricing challenging for the vol markets. With that in mind yen fwd vol stands out among the majors.

We expect FX spot gyrations to continue, but suspect that partial breakdown in safe haven correlations may be indicating that the global backdrop is messy but not necessarily as dire as the market sentiment suggests.

We prefer owning 3m3m fwd vols which are (at mids) 2 sigma too low vs the ATM vols (refer 3rd chart). 1vol b/o on 3m3m FVA (more than twice the historicals) is an impediment.

Performance of the long 3m3m FVA exhibits positive correlation with vol levels while offering a contained time decay during bearish trends for vols. Specifically (refer 4th chart) the back-test shows 3m3m USDJPY FVAs performing efficiently during major yen vol rallies (shaded episodes) and retaining P/L even as ATM vol starts to normalize lower. Courtesy: JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields