In the recent past, the trade protectionism theme shot back into focus as a potential major left tail risk for markets. Implied and realized volatility has rebounded from low levels driven by general risk-off moves in the market. FX vols climbed more than 1.5pts on VXY-EM basket and ~1vol pts on VXY-G10 within a week. The sharp vol rally eliminated the extreme cheapness of the EM basket, lifting the VXY-EM off the July multi-year low.

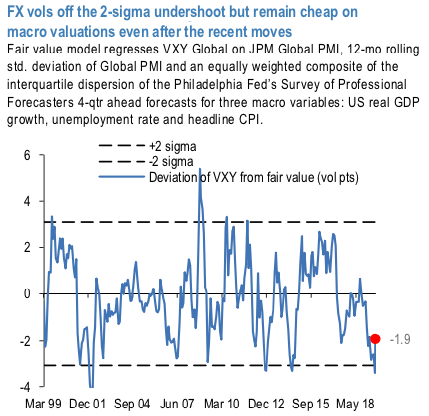

Nevertheless, VXY-G10 is only back to the year start levels and on our workhorse cyclical framework, which takes into account the trajectory and surprises in Global PMIs and ex-ante forecast uncertainty surrounding key macroeconomic variables, FX vols are now off the 2- sigma undershoot but remain ~2pts cheap on macro valuations even after the recent move (refer 1stchart).

Spot gyrations generated strong gamma returns especially in Asia EM and x-JPY (refer 2nd chart). How widespread and how impactful the trade escalation has been the best seen from the 1-week returns which are >90 percentile of YTD weekly returns for 26 out of 30 currencies in the Exhibit. We do not see a quick resolve and remain defensive though the current indications are that PBoC may want to bring back calm into FX.

The news of the additional US tariffs also resulted in EM currencies/equities crumbling overnight. Apart from the Chinese readings, Asian manufacturing PMIs came in mixed to weaker. Short-end EMFX vols are ‘waking up’ again, with Chinese equities slumping in early trade on Friday.

Overall, expect USD-Asia upside to persist, especially with regional currencies now lacking the buffer of net portfolio inflows. Asian (IRS) yields meanwhile may be expected to take the cue from the global core curves and explore the downside once again, flushing out any ambiguity witnessed immediately after the FOMC.Courtesy: OCBC & JPM

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch