Following some rather dull trading days, USD traders had actually hoped for today’s semi-annual hearing of Fed Chair Janet Yellen in front of Congress to bring some life into the exchange rates. But then things happened in rapid succession yesterday - to the dollar’s disadvantage.

The focus of USD investors rests mainly on monetary policy again. Following yesterday’s comments of FOMC board member Lael Brainard a Fed timetable seems to be increasingly emerging that corresponds to the one long since favored by us: the Fed is likely to announce the imminent end of the reinvestments from the QE programme in September.

No clashes with low-intensity jitters continuing through this month as the position shakeout in duration-heavy bond markets play itself out; indeed, the recent FX price action is very much in line with our baseline 2H’17 view of a moderate turn higher in vol. At the same time, however, we are skeptical that the ongoing bond sell-off will morph into a more sinister trigger for risk markets.

That said, these are not placid markets and there are a couple of lessons to be gleaned from the pattern of recent vol returns that can prove useful for defensive option plays:

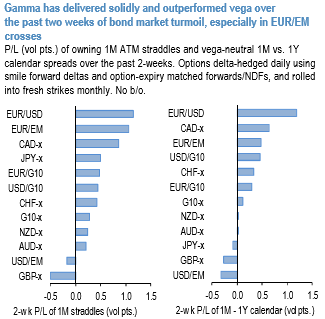

Gamma is performing solidly, and comfortably outpacing vega (refer above chart), which is to be expected when markets go into a pothole with ultra-low levels of frontend vol and steeply upward sloping vol curves. Vol curve flattening was indeed one of our core views for H2, and the upbeat performance of vega-neutral, long gamma calendars supports our conviction in employing them as defensive vehicles.

The currency bloc breakdown of gamma returns in the above chart is divulging. EURUSD and EUR/EM are the best-performing currency pairs, while USD/EM, GBP, and AUD-crosses have been disappointing. In general, owning gamma in USD - pairs and EUR - crosses - the two currencies at the heart of the rate normalization dynamic - appears to be a decent rule of thumb. The underperformance of USD/EM as a bloc is surprising and illustrates the wide dispersion in EM FX behavior.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons