We foresee next target for this pair is at 1.1317, RSI is currently trending near 58.2156, while %K crossover on slow stochastic at around 80 levels signifies bullish momentum is continuing. Bullish trend is still on for another 80-100 pips.

Option Strategy:

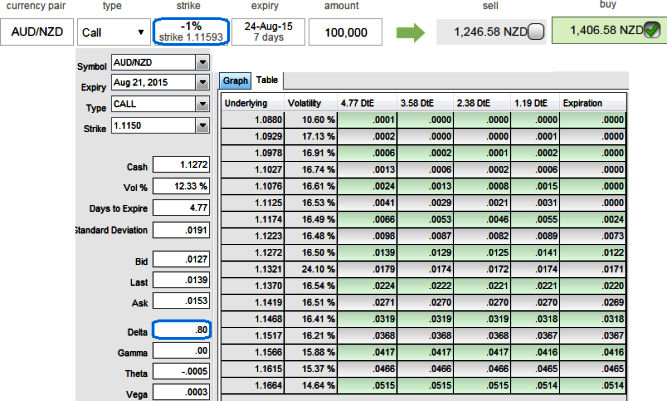

The moment when we advised ATM calls to be deployed in options strips, they were trading at NZD 668.25 , now have a look at the diagram fro prevailing prices of ATM calls and they are moving in line with healthy delta. We've been firm to hold on this strategy on hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Hold 15D At-The-Money 0.50 delta call and simultaneously hold 1 lot of 1M At-The-Money -0.50 delta put options with positive theta values and one more put option 1M At-The-Money puts after squaring off 1st option. The rationale was quite simple; in near term the pair may experience we foresee healthy upswings, so to participate in that uptrend, 15D call was deployed along with 1M put for hedging.

Huge returns achievable with the strip strategy even on speculating grounds when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

FxWirePro: AUD/NZD ATM calls of diagonal strips on the job

Monday, August 17, 2015 5:47 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings