AUDUSD in near-term perspectives: Looking technically stretched around the 0.8100 area.

The medium-term perspectives: Over the course of Q1 2018, we look for AUDUSD to return to the 0.75 area seen in early Dec 2017.

This seems most likely when interest rate markets remain no change in the RBA cash rate this year and if the prospect of increased supply chills the recent commodity price rally. But a firmer US dollar is probably necessary to get as far as 0.75.

This should occur if interest rate markets move closer to Westpac’s view of no change in the RBA cash rate this year and if the prospect of increased supply cools the recent commodity price rally. But a firmer US dollar is probably necessary to get as far as 0.75.

OTC outlook and hedging perspectives:

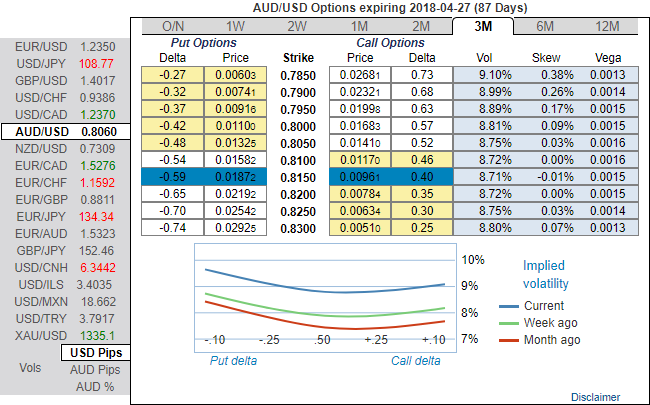

While using shrinking IVs of shorter tenors coupled with bearish neutral RRs could be interpreted as an opportunity for writing OTM puts or theta shorts in short run on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Without disregarding the Fed’s rate hiking cycle in 2018, the bearish stance of the pair has been substantiated by bearish neutral risk reversals and positively skewed IVs of 3m tenors which is an opportunity for put longs in long-term as the US central most likely to raise the Funds rates by 25 bps.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies by bidding 1m theta shorts, 3m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 15 levels (which is neutral), while hourly USD spot index was at a tad below 100 (highly bullish) at the time of articulating (at 07:12 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential