The RBA policy decision is expected to be on hold. The minutes of the April meeting singled out labor and housing markets as key areas being monitored closely. The stronger than expected jobs gains in March and new macro-prudential measures have further cemented the Bank's 'on hold' position.

China: The Apr Caixin Manufacturing PMI remained elevated at 51.2 in Mar but also indicated slower expansion relative to previous months. The Caixin index has been consistent with the NBS PMI which fell 0.6pts from near 5y peaks to 51.2 in Apr.

AUDUSD medium term perspectives: Although the pair bounces off the 0.7450, the upside area should be limited to 0.7600.

The modestly weaker than expected Australian CPI outcome has added yet another factor capping the A$: softer commodity prices; a more protectionist stance from US President Trump, and higher US yields if the Fed raises rates in June as we expect.

These leave the A$ with strong resistance at 0.76. We expect to see it heading towards 0.74 by year end.

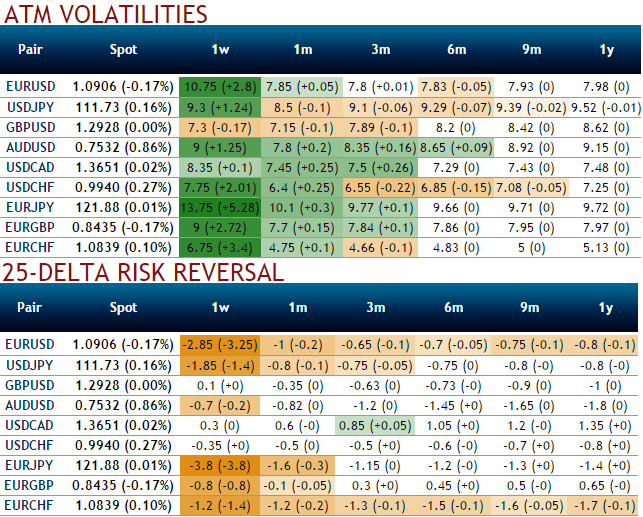

While delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.74-75 or below technical levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 1-3m risks reversals that would encompass Fed’s June meeting.

AUDUSD's higher IV with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025