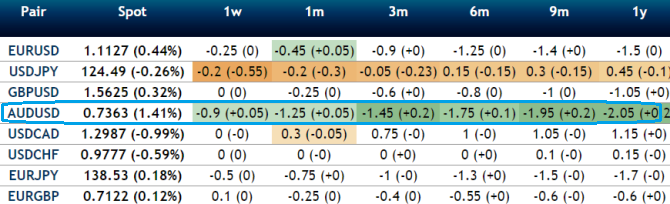

Delta risk reversals of AUDUSD: Despite the short-lived upswings to 0.7440, the OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid April 2013 and as a result delta risk reversal for AUDUSD was turning into negative.

From the nutshell, 25-delta risk of reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been over priced. As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

Technicals: On weekly charts stochastic curves remained below 20 levels yet it is attempting for %D line crossover which is a signals of current downtrend continuation, while to boost up this the bearish view prevailing prices are trading below moving average curve comfortably. While lagging indicator suggests the current spikes are well below 20 weeks moving average.

FxWirePro: AUD/USD dips to resume as delta risk reversal still signifies expensive downside hedging

Thursday, August 13, 2015 1:13 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate