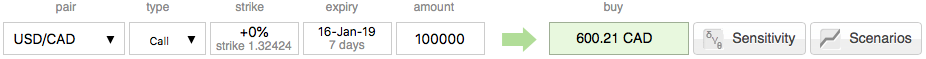

Please be noted that CAD call options seem to be overpriced as there exists disparity between the implied volatilities, pricing and NPV. USDCAD call options are trading at CAD 600.15, whereas the net present value is at 511 with IVs of 1m tenor is just shy above 7.8%, hence, these bullish derivative instruments are overpriced at 17.4%

The CAD is up modestly against G10 currency peers, and especially CADJPY is showing all signs of extension of its recent recovery while outperforming all of the G10 currencies into Tuesday’s NA session.

Domestic risk returns with the 8:30am ET release of international merchandise trade data for November, ahead of today’s Bank of Canada policy decision (quite a few expect for 25 bps hike and few expect it to be on hold) and MPR forecast update. Near-term rate expectations remain relatively muted however the recent curve inversion appears to be fading following the market dislocations from late December/early January. U.S.-Canada yield spreads are fading their recent contraction and the outlook for relative central bank policy presents a near-term headwind, given the aggressive recovery in Fed expectations. While crude oil prices remain critical as WTI nears the psychologically important $50/bbl level and measures of sentiment offer additional support as lower measures of implied volatility reduce the premium for protection against CAD weakness.

Overall, we are neutral-bullish into this week’s BoC, given the CAD’s impressive 3.2% rally from the Dec 31 low.

There are no doubt arguments for why the Bank of Canada (BoC) could take a break in the rate cycle tonight, as 3⁄4thof the market expects. At its December meeting it maintained its restrictive approach but it sounded a little more cautious than in October when it hiked the key rate by 25bp to 1.75%.

The CAD could no doubt cope with a rate hike even though it would no doubt push the CAD much higher in view of the market expectations. As long as USDCAD remains above 1.28-1.30 though the BoC is unlikely to worry. Courtesy: sentrix, ore

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 71 levels (which is bullish), hourly USD spot index was at -96 (bearish) while articulating at (09:45 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady