The economic recovery in the eurozone has strengthened and thanks to the prospect of an imminent exit from the ECB’s expansionary monetary policy, after the ECB had already removed the reference to further rate cuts from its statement, EUR has appreciated.

Well, for directional Euro bulls, it is worth considering additional expressions of Euro strength after a decent rally in EURUSD spot and vol this week, either by selling Euro-bloc correlates such as USDCHF, USD/Scandies, and USD/CEE, or buying EUR-crosses that have a reliable track record of co-moving with Euro.

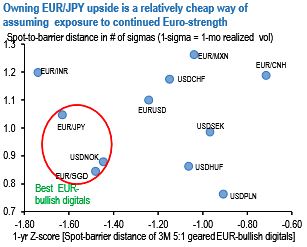

Only a handful of crosses satisfy the latter requirement; EUR/Asia, in particular, are predictable candidates (refer above chart) since idiosyncratic forces in managed, lower beta Asian currencies are often swamped by more powerful global forces during a concerted European surge.

Call spreads are the likely instruments to participate in additional EUR upside after this week’s high-velocity move; using 3M at-expiry digitals as an analytically simpler stand-in, above chart screens for bullish EUR spread plays within a narrow universe of viable proxies and recommends EURJPY, USDNOK and EURSGD options as better priced than EURUSD to layer on additional leverage.

We have long liked NOK as a valuation play, and there could be RV room for the krone to catch-up to the Euro now that the Norges Bank has removed its long-held rate easing bias and oil has rebounded above $45/bbl.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom