The news that the EU was going to offer its British partners a further reaching (“super- charged”) free trade agreement than ever entered with anyone else before provided decent support for Sterling at the end of last week. The reaction was not justified for several reasons.

First of all, a free trade agreement seemed the only logical answer in view of the many “red lines” on both sides. At least the EU had made this clear often enough. It may be seen as positive that the agreement is aimed at facilitating closer relations than with other trade partners, but the extended elements refer mainly to cooperation in the area of defence, a move that is no doubt welcome but of little real economic relevance.

Secondly, the EU would therefore reject Theresa May’s Chequers Plan, according to which the UK would have de facto remained in the customs union in terms of goods trade, and would instead strengthen her rival Boris Johnson’s proposal of a Canada-plus free trade agreement; which means that May’s position would be weakened.

And thirdly, this seems to be the most important aspect in my view – the proposal still does not solve the issue of the Irish border. This week the British government wants to put forward a new proposal that will reduce the checks between Northern Ireland and the rest of Great Britain to a minimum.

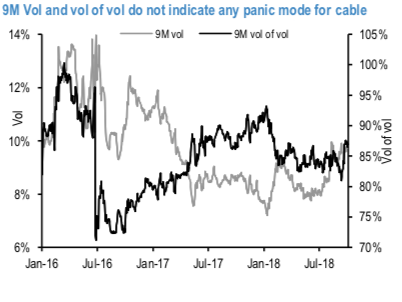

Accordingly, the investigation of sterling volatilities is reprised as carried out in an earlier piece. The value of owing optionality for hedging Brexit risk is confirmed.

We consider a worst-of puts structure for hedging a scenario where wider BTP-Bund spreads could push 14% EUR lower vs G7 safe havens.

Assessing what the market is currently pricing for different scenarios, corresponding to probabilities (estimated in-house) of 60% for the EU-UK deal case vs. 20% each for no-deal and no-Brexit cases. With 9M cable- implied vol currently at 9.8% (refer above chart), we estimate the vol for the baseline scenario at 8.5% and that for the two risk-scenarios at 11.6% (up from the previous estimate at 11.2%). While the value of the high-vol mode is not low on a standalone basis and is higher than one month ago, a comparison with the patterns observed in 2016 around the Brexit referendum confirms the value of owning optionality for hedging non-core scenarios. Courtesy: JPM, Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -95 levels (which is bearish), while hourly USD spot index was at 71 (bullish) while articulating (at 13:20 GMT). For more details on the index, please refer below weblink:

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data