With the Italian parliamentary election only one week away, polls continue to point to a hung parliament with no clear majority in sight.

However, irrespective of the governing coalition formed after the election, we do not expect the new government to undertake the necessary structural reforms to kick-start the Italian economy.

Well, it is seen as at the medium-term Italian debt dynamics under three different political scenarios: the good, the bad and the ugly. In light of a rise in global yields, weak growth prospects and a fragile banking system, it would not take a lot for Italian debt dynamics to worsen.

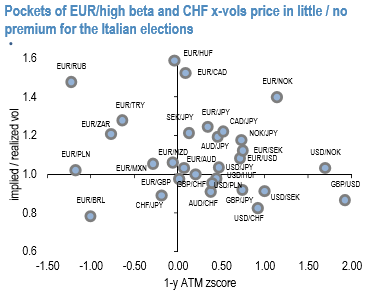

Well, in gamma space, we find vol risk premia narrowly concentrated in EUR/low beta pairs (refer above chart). This leaves attractively priced pockets of direct exposure in EUR/high beta.

EURNZD and EURAUD strike us as good value with little/no event risk premium roll-off exposure alongside EURMXN where gamma has been consistently realizing and which has an additional kicker from the upcoming 7th round of NAFTA negotiations and since recently tougher US stance on trade.

Among the most direct EUR proxies, the attractively priced gamma performing CHF vols and x-vols (USDCHF, AUDCHF, GBPCHF, and CHFJPY) are bound to get a fair windfall of contagion in case of a surprise election outcome on the back of the likely SNB intervention. Further support to USDCHF realized vols has come from Powell’s 1st testimony as Fed Chair yesterday, March payrolls and FOMC.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge