Glimpse on Macroeconomic Environment:

Japan recorded a Current Account surplus of 1809 JPY billion in May of 2016. Current Account in Japan averaged 1082.21 JPY billion from 1985 until 2016, reaching an all-time high of 3360.40 JPY billion in March of 2007 and a record low of -1456.10 JPY billion in January of 2014.

As per the Abenomics, which eyes on fresh fiscal easing, made possible by the fact that the BOJ has already bought a decent chunk of the government’s debt. That edges Japan closer to central-bank financed fiscal policy and raises the stakes – for the economy and the currency.

However, the balance of payments data show significant long-term capital outflows from Japan, which suggest that the yen’s bounce, at these levels, is overdone.

OTC Outlook:

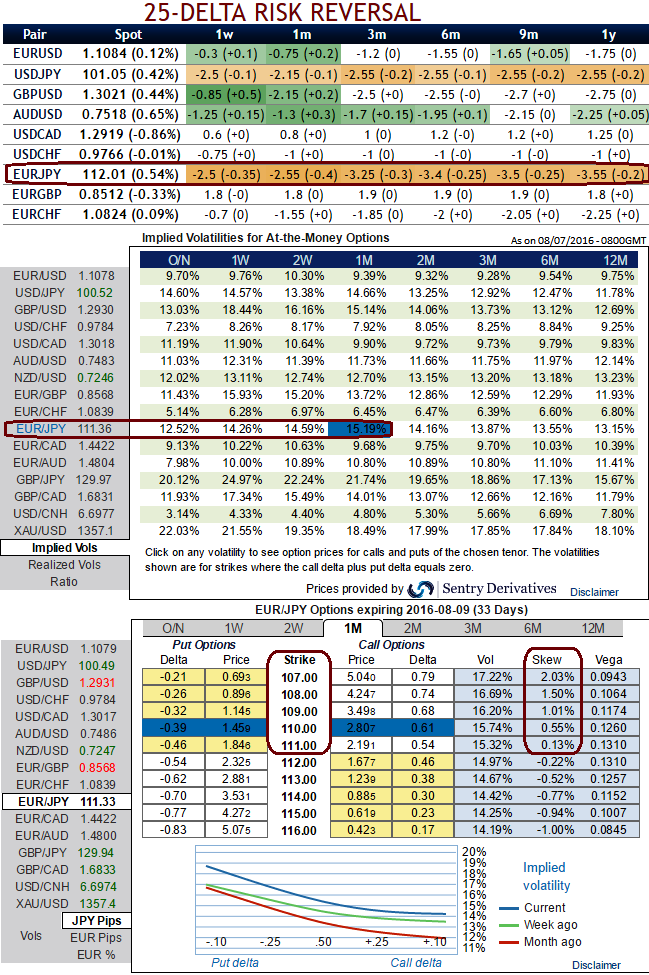

The implied volatility of ATM contracts for near month expiries of this the pair is at around 15.19% which is the second highest among G10 currency space (see above nutshell), and as the delta risk reversals increasing up extensively with negative flashes that signify the hedging sentiments are well equipped for downside risks over this period of time. Skews of these 1m vols suggest the underlying spot to shift towards OTM strikes.

Thus, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising both ATM and OTM instruments ITM shorts in the short term would optimize the strategy.

We think that the fear of broader global risks now appears to outweigh worries about further ECB and BoJ policy easing. Given concerns on limits of the policy arsenal at the BoJ and rising euro-centric risks.

We recommend initiating shorts EURJPY positions for long-term hedging but by capitalizing on short-term upswings, preferably via options acknowledging the recent upticks in the implied volatility of Euro crosses (see nutshell).

Considering Euro's implied volatility and OTC market sentiments we think more downside risks are still on the cards in long run, as result of deploying ATM delta instruments would be the answer for both speculation and hedging if you think speculation in potential uptrend in short terms is not possible as delta risk reversal suggested puts have been overpriced then use OTM puts that are available in cheaper premiums comparatively. But don't you dare to buck the trend and miss long opportunities in prevailing bear trend.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand