Bearish EURJPY scenarios (see 127) if:

1) The euro area growth fails to rebound above 2%

2) EUR appreciation and/or sluggish core CPI delays ECB policy normalization

Bullish EURJPY scenarios (foresee 131) if:

1) Euro-area growth rebounds to 2.5-3% by mid-2018;

2) ECB becomes more comfortable with progress on wages and core inflation and softens calendar-based rate guidance

3) The BoJ does not move even if the core inflation rate rises more than expected.

OTC outlook:

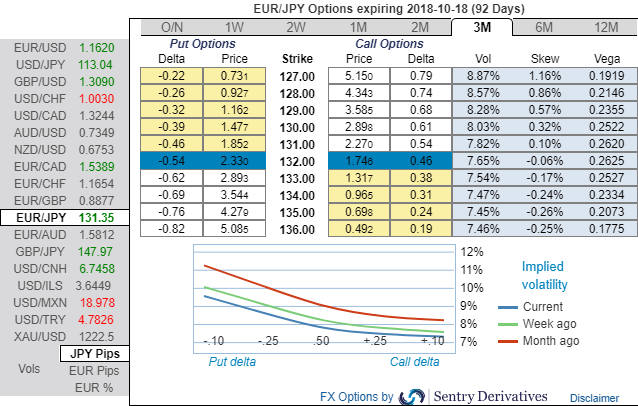

Most importantly, please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests in the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to hit upto 127 levels so that OTM instruments would expire in-the-money.

While negative risk reversal numbers of all euro crosses (especially EURJPY) across all tenors are also substantiating bearish risks in long run amid minor abrupt upswings in the short-term.

Technically, we already raised a caution about EURJPY bullish risks in short-term trend. For more readings, refer below weblinks:

Amid bearish hedging sentiments, IVs of 2w tenors are shrinking away (on the lower side) which is conducive for put writers.

Options strategies for hedging:

Contemplating above fundamental driving forces and OTC indications, we’ve devised suitable options strategies:

On hedging grounds initiate 3m longs in EURJPY (1%) OTM -0.39 delta puts for aggressive bears, simultaneously, deploy theta short in 2w ATM put options. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Sell 4M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -60 levels (which is bearish), while hourly JPY spot index was at 46 (bullish) while articulating at (08:39 GMT). For more details on the index, please refer below weblink:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?