Gold futures on Comex were up 0.78% at $1,338.0 a troy ounce by 11:36 GMT, the highest since February 20 as sentiment on the U.S. dollar weakened due to a decline in bond yields and as sentiments developed more vigilant ahead of new Federal Reserve head Jerome Powell's testimony this week. We have a pretty low-level data week ahead, with US Payrolls being rolled out a week and end of month flow likely to be a main driver of FX through to Wednesday. As such, the focus this week is probably going to be on speakers. The main event in this regard is obviously the new Fed Chair, Jerome Powell’s testimony on Tuesday and Thursday.

Good ownership in front end Gold skews: With Gold front vols bound to remain firm for longer and as the late cycle Gold rally takes hold on the back of the late Fed, Gold skews should stay supported even as 3M skews are at the highest level since Aug 2017.

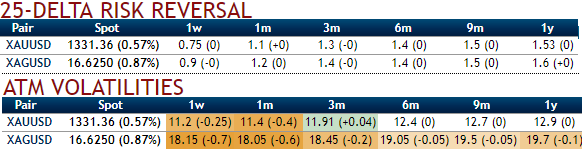

Returns from delta-hedged 25 delta riskies (refer above chart) have held well as skew pricing remained within range and despite an aggressive 2017 global vol sell-off.

While the Italian election may turn out to be materially more muted than last year’s French election 1st round which pushed 3M XAUUSD skews to the highs of 2.7 vols, at about 1.2 vol of positive static carry on 3M-1M segment 3M XAUUSD 25D riskies provide an attractive positive static carry risk-off hedge.

We recommend buying delta-hedged 3M XAUUSD 25-delta risk reversals @ 1.3/1.6 vol.

Currency Strength Index: FxWirePro’s hourly USD spot index has shown -37 (which is bearish), for more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data