FX volatility is easing off following the March Fed hike and the reduction in political risk, following the defeat of the populist candidate in the Netherlands and a wider bookmakers’ spread between Macron and Le Pen (refer above graph).

In our view, the FX euro vol market is complacent compared to the bond market, seeing the resilient 10y OAT-Bund spread. This relief offers an attractive entry point to hedge a large euro downside move via options.

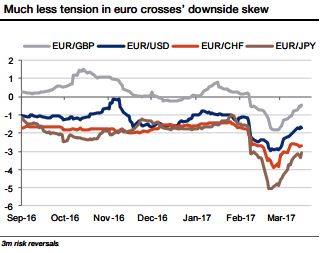

The 3m downside skew in euro crosses retraced sharply, and almost fell to last year levels in the EURUSD and EURGBP (see above graphs for risk reversals and vols).

The EURJPY and EURCHF skew are also materially less expensive, with, in particular, the EURJPY 3m risk reversal returning below -3 from -5. Indeed, the 3m ATM vol is not that high compared to the spot level, further suggesting designing a long vega hedge.

EURJPY implied volatility is already high compared to realized volatility but would spike much higher if the spot were to collapse (negative vol/spot correlation – see top chart). Indeed, the 3m ATM vol is not that high compared to the spot level, further suggesting designing a long vega hedge.

In addition, an effective hedge must not be conditional but delivers anyway if the feared market scenario becomes reality. Also, euro spot market liquidity is very likely to deteriorate sharply if Le Pen wins, prompting large intraday moves. In these conditions, the most appropriate strategy is buying a one-touch option: it takes advantage of the recent skew cheapening, would highly benefit from a rise in downside vol and is the best way to catch a short-lived bottom in the spot.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different