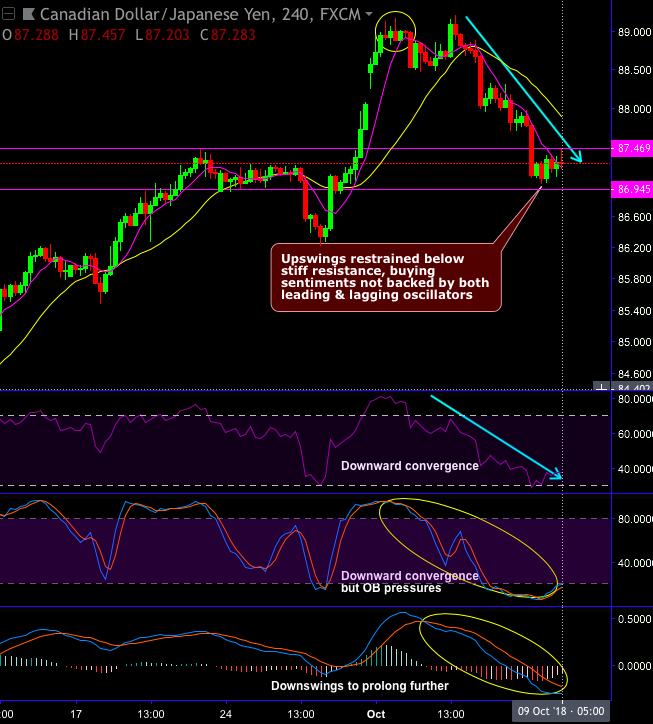

CADJPY forms shooting star pattern at 87.875 levels that nudges price towards EMAs on monthly plotting. The same bearish patterns have occurred at 88.926 and 88.890 levels on daily terms as well. Ever since then prices slide below DMAs.

The stiff resistance zone is observed at 87.469 levels, while both momentum oscillators (RSI & Stochastic curves) on monthly terms show upward convergence but slight overbought pressures that indicates the faded strength and the losing bullish momentum in the prevailing upswings.

Monthly RSI and stochastic curves are popping-up with overbought pressures, hence, it is snap rallies so as to provide a better entry level for the fresh short trades. Strong support is seen at 86.773 levels (i.e 7EMAs).

On a broader perspective, the major downtrend of this pair has gone in consolidation phase since December 2015 (refer monthly plotting). Shooting star pattern at juncture hampers previous bullish momentum on this timeframe.

Trade tips: Well, on trading perspective, at spot reference: 87.292 levels, contemplating above-stated bullish pattern, it is advisable to trade boundary binary option strategy using upper strikes at 87.469 and lower strikes at 87.033 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains between these two strikes on the expiry duration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 84.000 levels in the near terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards -38 levels (which is bearish), while hourly JPY spot index was at 83 (bullish) while articulating (at 08:13 GMT). For more details on the index, please refer below weblink:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings