Thanks to the inflation data the upside in USDCAD was successfully defended. The Canadian inflation data for November surprised on the upside and gave an early Christmas present to CAD in the shape of a rally. The overall rate rose to 2.1% YoY. The different measures of core inflation paint a very similar picture. That means prices are rising after-inflation rates at the lower end of the Bank of Canada’s (BoC) target corridor had already led to concerns that the rate hikes in the summer could have been a policy error.

Crude oil endured a wild ride over the past two weeks, first breaking above $65/bbl (Brent) on news of the Forties pipeline outage but collapsing after on increased rhetoric around exit strategy from the current production cut deal, U-turns from Nigeria and Libya in refusing to abide by last month’s agreed output caps, OPEC’s higher shale supply projections for 2018 and weak DOE inventory numbers.

These moves in crude correlate only loosely with moves in petro-FX –indeed, oil and oil currencies have decoupled for a while now – but only serve to increase the marginal volatility of CAD and CAD-crosses at a time when the currency is being buffeted by cross-currents of BoC policy shifts and international trade frictions (NAFTA).

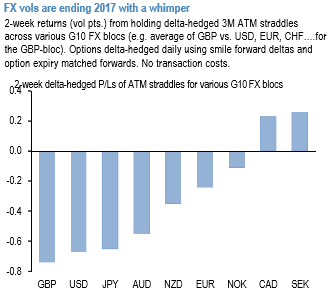

The above chart explains that the CAD-crosses have been among the better performing vol blocs in the recent times, and the succinct outperformer on relative basis among G10 FX space over the past year with virtually flat yields since the broad vol collapse in 1Q even as others – with the distinguished exception of sterling – prolonged to crumble (refer above chart).

Nevertheless, CAD implied vols have not re-priced in any expressive manner to reflect this delivery: USDCAD 3M ATMs are spiking only 0.2 vols over the past month, crosses such as EURCAD (+0.5) and CADJPY (-0.2) have not fared a whole lot better. A portion of this inertia, perhaps, reflects seasonal year-end vol softness, but if this state of affairs persists even after markets return in the New Year when both interest rate and trade talks pick up renewed steam, it should be an opportunity to pick up cheap volatility.

While CAD gained 12% against the US dollar during the summer, and this was probably too fast. The recent correction was due, but we expect the Canadian dollar to confirm durable gains over the medium term. The USDCAD hit and bounced at a fresh 1.21 low last September, setting a new horizontal support, which is now quite distant from the current 1.28, leaving downside room.

The BoC is not yet out of the woods: the BoC itself states that prices are rising due to temporary factors (e.g. petrol prices) and core inflation is rising only very slowly. The solid growth in Canada is positive, but the BoC still sees considerable risks for it, not least due to the NAFTA negotiations. Even though the November data supports the BoC’s cautiously hawkish approach, we do not want to be tempted into excessive CAD euphoria and would treat the pre-Christmas rally with caution as the increases in inflation rates will have to prove to be sustainable first. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts