The reasons for a rate hike on the part of the Bank of Canada (BoC) in two weeks’ time cannot be ignored.

But the inflation data for May published last Friday briefly rocked the market as it was slightly weaker than expected so that the CAD eased briefly. The overall inflation and the different measures of core inflation are comfortably at the centre of the BoC’s target range and the inflation trend too does not leave much to be desired.

While the unemployment rate has reached historic lows and the business survey for Q2, due for publication today, is likely to confirm the image of dynamic economic activity. A thick, dark thundercloud remains on the economic sky though: the NAFTA negotiations and the concerns about an escalating trade conflict. There is quiet on the NAFTA front following the introduction of tariffs on steel and aluminium imports and the tough language between the two heads of government, as Trump is focusing mainly on China, technology and cars now and has since identified all nations trading with the US as enemies.

Next week the Canadian representative in Washington will meet the finance ministers of the Canadian federal states, the US diplomat in Canada as well as some high-ranking representatives of Canadian companies and central bank governor Stephen Poloz in Ottawa.

This illustrates the lingering concerns the Canadian leadership has about further developments in the trade conflict.

While a rate step by the BoC in July is priced-in at 2/3rd, that credits to be given for the US and China. There is still a residual risk that the BoC will wait despite all the positive aspects of the domestic economy before resuming the rate hike cycle. However, we think that the BoC will take action in July and that CAD will be able to appreciate.

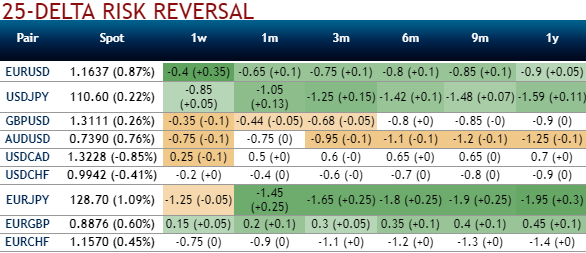

Please be noted that the risk reversals of USDCAD for short-term tenors are showing minor changes (changes only in 1w expiries), while bullish hedging bids remain intact for the long-term. While the IV skews are also positive for 1w tenor is slightly stretched out for OTM puts, while the 3m IVs are still positively skewed which means bullish risks remain intact despite the above stated fundamental factors. While 1w forward rates show negligible changes and bearish targets in the longer tenors.

Hence, we advocate staying short in 1w USDCAD forwards with a view to arresting potential bearish risks in the near-term and longs in 3m forwards. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 145 levels (which is highly bullish), while hourly USD spot index was at -5 (neutral) while articulating at (14:00 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures