The recent commodity price meltdown and especially the crude's struggle causing the reaction function of firms in the Canadian oil and gas sector proposes that business investment may be even more of a drag on 2016 growth than previously thought.

The Business Outlook Survey by Bank of Canada has been lackluster in Q4 2015 and has amplified this theme, as investment intentions moved to their lowest readings since the 2009 recession. This has prompted the market to price in the increased probability of a rate cut at the January 20 meeting.

Regardless of whether or not the Bank of Canada cuts rates, we believe that the uptrend in USD/CAD will persist. The 1.5000 level now serves as an anchor for the market from a behavioural/sentiment perspective.

Currency option framework: (AUDCAD Daigonal Condor Spreads)

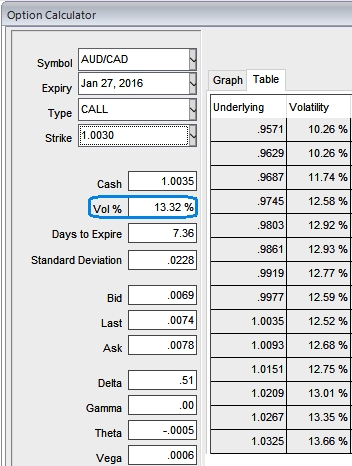

Our opinion on AUDCAD in Q1 2016 has differently attributed from what we have mentioned above, some uptrend sentiments but we expect range bounded movements in medium to long terms considering the increased volatility (projected a gradual increase in 1m-3m ATM contracts at 10%) and neutral delta risk reversal.

When we had to study and compare this fluctuation of volatility and its comparison with risk reversals of this pair we tend to increase upper limits in the range as a result of increase in the IV.

So to protect the FX portfolio from this fluctuation the below strategy is advisable, the recommendation goes this way, shorting OTM call and buy deep OTM delta calls, simultaneously short ITM call and buy deep ITM delta call options. Prefer as shorter expiries as possible on short side (let's say 4D), 1M expiries on long side as the implied volatility in OTC fades away after the BoC policy actions.

The highest loss for this option strategy is equal to the initial debit taken when entering the trade. It happens when the underlying exchange rate on expiration date is at or below the lowest strike price and also occurs when the pair is at or above the highest strike price of all the options involved.

FxWirePro: CAD seems vulnerable regardless of BoC policy stance - stay hedged via AUD/CAD condor spread on HY vols

Wednesday, January 20, 2016 7:05 AM UTC

Editor's Picks

- Market Data

Most Popular

3

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary