Fearful that investors might be losing confidence in the ECB’s ability to bring inflation back up to its goal, policymakers have hinted that they are prepared to increase stimulus measures.

The first port of call is expected to be a potential change in the ECB’s rates guidance at this week’s (25 July) meeting, which would pave the way for interest rates to be cut by as much as 20bps in September, possibly with the introduction of tiering.

The bar to restarting QE is higher, but a resumption of net asset purchases could begin later in the year. A relaxation of self-imposed buying limits and/or a shift towards more corporate bonds would create more headroom.

A rate cut on Thursday or a signal of an earlier start to QE in September are possibilities but are not considered to be the most likely outcomes.

On the economic surface, no doubt the ECB will tolerate a few months waiting time for the data to improve, but the market will likely want to see an improvement pretty soon. If that does not materialize but if instead economic data disappoints over the coming days and weeks the market could have EURAUD a brief look below 1.58 levels in the short-term and aim for the 1.6140 mark medium term.

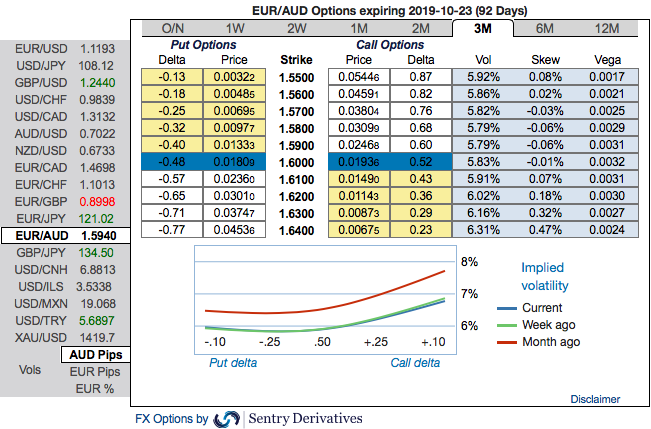

OTC Indications and Options Strategy: Please be noted that IV skews of EURAUD are stretched on either side, the positively skewed IVs of 3m tenors are signifying more hedging interests in both bullish and bearish risks. But more bids for OTM calls of this tenor indicate that the underlying spot FX likely to spike up to 1.64 levels and bids for OTM puts show 1.55 levels.

Contemplating fundamental and OTC factors as explained above, although it is sensed that all chances of Aussie dollar looking superior over Euro in the near term and vice versa in the medium-term future; accordingly, we advise to hedge the puzzling swings through below options recommendations.

The execution: Spot reference: 1.5921 levels, buy 2 lots of at the money 0.51 delta call option of 3m tenor and simultaneously, buy at the money put option of similar expiries. The option strap is a more customized version of straddles but instruments slightly biased bullish risks.

Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Hence, any hedger or trader who believes the underlying currency is more likely to slide downside can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix & Lloyds

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close