The recent publication of the PMIs in a number of countries illustrated a significant improvement of sentiment. It seems questionable though whether sentiment in Mexico has improved to the same extent (publication of the PMI today). But the corona virus is still spreading rapidly in Mexico and it is likely to be some time before the pandemic can be contained. The successor agreement of the NAFTA, called USMCA, will come into force today and that is likely to kindle hope in Mexico that the economy will recover rapidly from the corona shock as a result of foreign trade. The sceptics are likely to remain in the majority though. While the pandemic is still limiting economic activity or there is a risk of more severe restrictions in the future, the economy is likely to recover only slowly. Moreover some of the Mexican President Andres Manuel Lopez Obrador’s decisions caused uncertainty amongst companies, most recently also amongst foreign companies. Foreign as well as domestic investors have to expect their plans to be thwarted by the President, regardless of whether the projects have already been initiated. This reduces the attractiveness of Mexico as a location for investors. And in the end US President Donald Trump’s political decisions also entail risks. Regardless of a trade agreement Trump has proven repeatedly in the past that a country can quickly fall into disgrace.

We therefore expect that the economic recovery in Mexico will be rather slow. If market sentiment improves again the peso is likely to be able to benefit to some extent, but the depressed economic outlook is likely to limit the appreciation potential.

The peso has appreciated close to 8% over the last month, outperforming most of its EM peers, though still remains 15% weaker YTD. The recent rally was driven by a general improvement in risk sentiment in EM FX, helped by COVID-19 re-openings, a China V-shaped recovery (which helped EM BoP dynamics also), cheap valuations and very light positioning. MXN ticked all these boxes while also enjoying among the highest real rates in EM, which supported its rally further.

OTC Updates and Options Strategies:

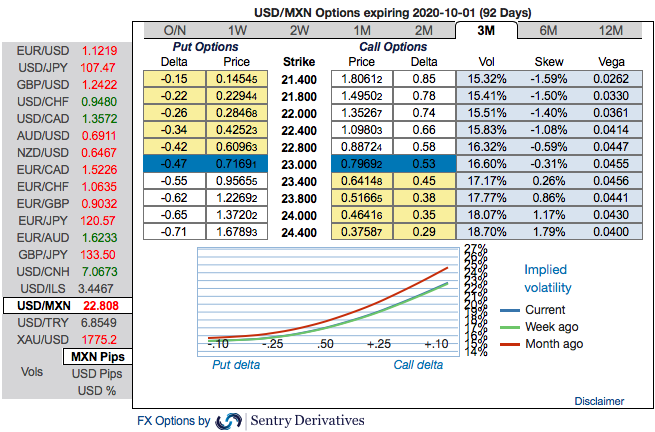

As stated in our previous posts, the positively skewed IVs of USDMXN of 3m tenors have delivered as expected and have still been indicating upside risks (bids for OTM call strikes upto 24.40 levels is observed), while IV remains on lower side and it is perceived to be conducive for options writers.

Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years.

3M USDMXN ATM/25D 1*1.5 vol ratio call spread vs 22.80/25.77 indicative (spot reference: 22.90 levels). Courtesy: Sentry & Commerzbank

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation