The German IFO index has produced upbeat numbers at higher levels today (actual 117.5 versus 116.6 and the previous 116.8) - similar to the PMIs from the euro zone yesterday - thus confirming the euro bulls in their view. However, this is unlikely to lead to massive gains in the euro.

Nov flash Markit manufacturing and services PMIs are out. Both indices have maintained a very positive level of (58.5 and 55.0 respectively), consistent with the uplift in growth in the region. The ECB minutes may contain some detail on the discussion around the tapering of their asset purchase program to 30bn from 60bn out to Sep 2018 which was announced at the Oct meeting.

Our RBNZ outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%.

Gamma ownership in EUR and USD against EMFX space is rendering lucrative options on central bank meetings (c.f. BoE), and in vega-neutral steepener format along steep vol curves.

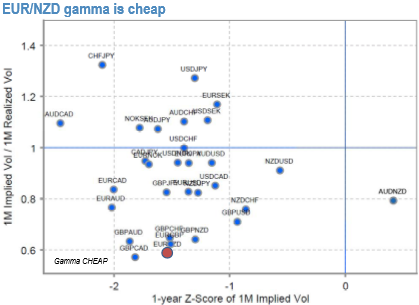

EURNZD gamma is still good value on RBNZ’s status; +2M/-6M calendars in EURTRY and USDMXN screen cheap.

Gamma is always a positive value, therefore you add Gamma to the value of the current Delta to estimate the new Delta in a rising market and you subtract Gamma from the current Delta to estimate the new Delta in a falling market.

EURNZD is the NZD-cross that screens the best value in gamma to benefit from such a turn of events (refer above diagram; 2m ATM 7.6% vs 1m tenors are 7.6%, while hourly realized vol 1-wk 7) and is worth holding into the event.

Directional plays for a tactical NZD bounce could take the form of either 1M 1.7682 EUR put/NZD call one touches (5X gearing off spot ref. 1.7262) or 1M 1.7682/1.671.65 put spread (3.5X).

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above 152 levels (highly bullish), while hourly NZD spot index was inching higher towards -2 (neutral) while articulating (at 10:55 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios