Dollar tantrum is still on despite substantial hurdles cleared in the US tax reform process, and a Fed rate hike. The conviction of broad USD strength through 1Q seems to be shrinking away as the greenback has failed to respond to the recent tax reform developments and disinflation uncertainty is weighing once more, moreover, US Fed remained dovish by not signaling acceleration in hikes for 2018 despite building in assumptions of fiscal stimulus. This implies any 1Q dollar strength might be much narrower and a greater likelihood that the range-bound and idiosyncratically driven conditions for the past month will spill over into 1Q’18.

When the tide and wind are moving in opposite directions, the sea is rough and sailing is hard work. The wind is in the euro’s sails, pushing it higher as the economy grows, the ECB edges away from post-GFC policies and the currency’s undervaluation support it. However, the tide of positioning (long euros) and yield differentials (still heavily in the dollar’s favor) is against the euro. The upshot is that progress from current levels towards ‘fair value’ somewhere closer to EURUSD 1.25, seems to be choppy and sluggish.

Well, all these fundamental developments are factored in EURUSD OTC markets.

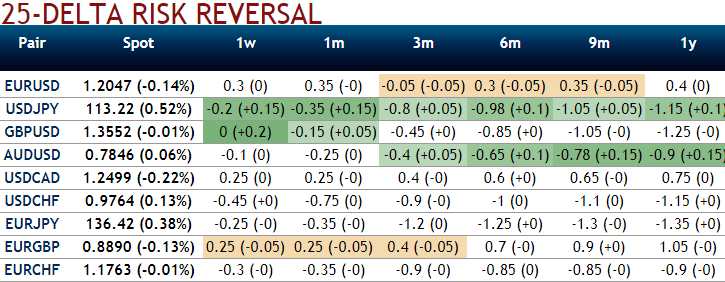

Let’s glance at sensitivity tool and risk reversals that indicate no changes in the hedging sentiments in next 1m time and mounting hedging sentiments for bearish risks of the underlying spot FX prices in next 3m-9m timeframes.

This sentiment is substantiated by the positively skewed IVs of 1m/3m tenors that have been signifying the hedgers’ interests of both OTM calls in 1m expiries and well balanced that shows interests in put strikes upto 1.18. Hence, this means that the ATM instruments have likelihood of expiring in-the-money within their respective tenors.

Accordingly, in order to arrest this upside risk that is lingering in short-term trend and the major declining trend, we recommend diagonal debit put options strategy that favors in reducing hedging cost.

Based on this rationale, conservative hedgers can prefer the below strategy:

Diagonal Debit Put Spread = Go long 3M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts