The USDTRY is slowly moving back towards the recent highs of 4.0345 level, which could be retested again. As the TRY has depreciated by almost 10% against the dollar compared to the previous year, the currency weakness could push inflation up again and thus exert renewed depreciation pressure on the lira due to the well-known feedback mechanism.

The defensive ploy of using high carry to subsidize the cost-of-carry of long vol is more appropriate to apply to currencies like TRY at the other end of the spectrum, wherein the broader terms, the macro standpoint is bearish. The EMEA analysts note that real yields in Turkey are still too low to sustainably bring down inflation, the current account deficit continues to widen, and the likelihood of comfortably funding the BoP through a repeat of 2017’s heavy portfolio inflows are slim.

More than outright long vega, bearish TRY views are well expressed through partially delta-hedged risk-reversals, in our view.

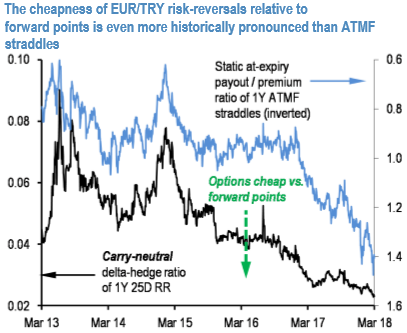

While ATM vol is cheap vs. carry, risk-reversals are even cheaper. One measure of a carry-adjusted risk reversal is carry-neutral delta-hedge ratio – the notional of forward delta hedge that needs to be layered atop unit notional/leg of a risk-reversal in order for the static points carry of the forward at expiry to completely offset the net option premium of the risk-reversal.

The lower this ratio, the cheaper the risk-reversal; in extremis, a ratio of zero indicates that the risk-reversal itself is costless and requires no bleed-reducing forward hedge overlay.

The above chart shows that this gauge is historically even more extreme than the corresponding metric for ATMF straddles.

Carry-neutrally delta-hedged risk-reversals are not just skew valuation metrics, but can also function as tradeable constructs for playing defensive directional views. Consider the following as a bearish TRY expression:

Off spot ref. 4.9345 and 3M forward ref. 5.0620, buy €100mio/leg of a EURTRY 3M 5.22 / 4.82 risk-reversal @ 76bp/92bp net premium indic. (vols 12.4/13.1 indic. vs. 10.6 choices) and sell €25mn of EURTRY 3M forward.

The notionals of the option and forward legs are sized such that the static carry on the forward with unchanged spot completely offsets the net riskie premium. The net package has a BS forward delta of €24mn (€49mn of the risk reversal -€25mn of the forward), which is, in theory, “carry-free.”

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand