The USD pairs remain volatile with 10-year US rates on the move. However, following a week of jittery FX spot, the universe of cheap defensive plays is rapidly shrinking. Front-end USD risk reversals have almost fully retraced back to near the January high.

At around 7.5vol handle (up about 0.4vols since last week, VXY-GL basis) front vols appear to offer more opportunities for those looking for defensive gamma hedges.

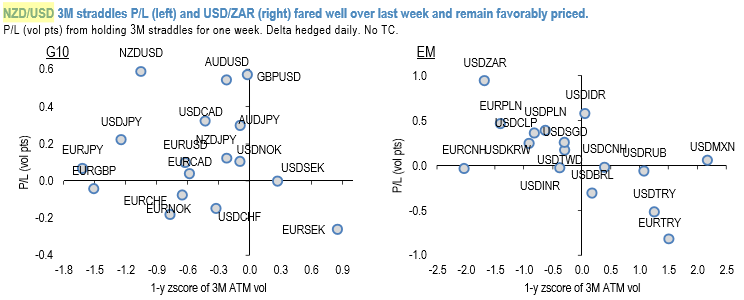

With the focus squarely on the US rates, arguably the USD vols are the place to be. To get a measure of the recent long gamma performance we look at P/L from holding 3M straddles (initiated one week ago) but we strip out the implieds vol rally component from the P/L.

An underlying assumption is that if high-frequency jitters persist (for now no sign of abating) holders of gamma straddles should see similar returns going forward.

Two additional factors to consider:

1) The vol pricing (especially on the back of the sharp really over last few days) –we assess it via 1-year z-score of ATM vols, and

2) 3M-1M roll down the vol curve – which turns out to be modest due to the recent flattening.

The above chart displays G10 and EMFX universe of 3M straddles, respectively. Unsurprisingly, high beta NZDUSD in G10 and USDZAR are two standout candidates with solid P/Ls over the past week. Both remain priced attractively (largely due to the favorably low vols prior to the ongoing vol rally).

USDJPY, a generic, catch-all risk off hedge, landed in the promising upper-left quadrant and screens cheap on implied vols (1.2 sigmas below 10Y average) but its skinny P/L and recently chronical realized vol underperformance makes as wary of yen gamma. For the time being, we pass on EUR cross vols aiming for a more direct exposure. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure