As the Fed maintained status quo at the conclusion of its monetary policy meeting on Wednesday but hinted that a hike could come in December if the job market continued to improve, the key benchmark US treasury yields moved lower over the past week, led by shifting perceptions over the pace of US interest rate hikes. Despite a relatively quiet week for euro area data, the EUR strengthened against its major currency peers. EUR/USD rose back above 1.12.

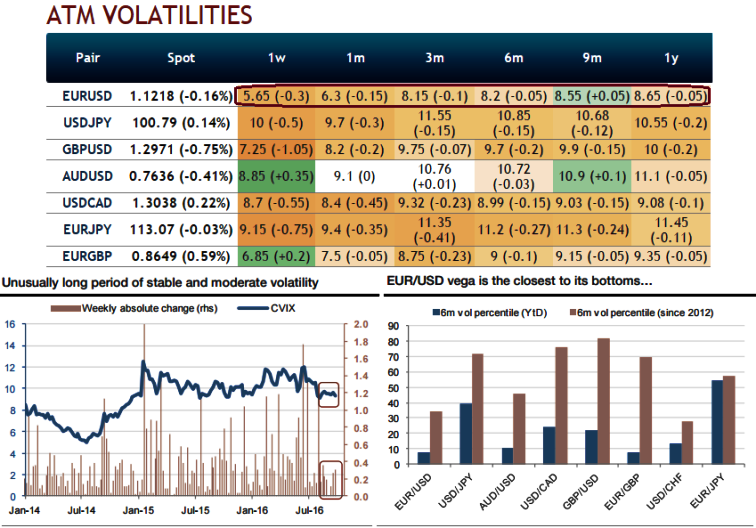

While in the FX options OTC markets, the current lows suggest multi-month volatility hedges, as in the medium term central bank activity will increase and political risk will stay high.

Central bank activities: This week, the Fed did not clearly signal that it was going to hike or not, but with one hike removed in 2017, the timing of the first hike of next year will be a source of market nervousness. At least uncertainty about the reaction function will return.

Also, the BoE’s full response to the Brexit shock has still to be seen. In Asia, the Bank of Japan’s decision to control the yield curve suggests that it is running out of ammunition, so the market might challenge its policy commitment.

Political risk is also going to take centre stage. The US election presents a major risk for the FX market in the event of a Trump victory, as the today the US election campaign would enter the critical phase with the first TV debate of the Presidential candidates. The polls suggest that it will be a neck-and-neck race. That means it is high time to look at the question of what an election victory for Donald Trump would mean for the US currency. His policies could differ fundamentally from that of previous administrations – unless everything we have heard from him so far were simply empty phrases. A Trump victory, therefore, has the potential to be of relevance for USD exchange rates.

The details of Brexit implementation and Article 50 activation are far from clear, and in emerging markets, the “key man” risk is a major factor of institutional instability involving the EM currencies with the most liquid option markets (ZAR, TRY).

While in the FX OTC markets, EURUSD is the pair to perceive the least IVs among G7 currency space. An unusually long period of low volatility of volatility is going to be concerning given that volatility is not that low.

It is quite unlikely that volatility can stay at the same time moderate and stable. Such levels are defining an unstable equilibrium, characterised by room both at the bottom and the top. Since the start of July, the CVIX weekly changes have been smaller than 0.5 vols, except in one week only when the change was 1.3 vols (see above graphs).

Hence, according to current market pricing, EUR/USD has the cheapest forward volatility among the most liquid G10 pairs on both the 6m6m and 1y1y tenors.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist