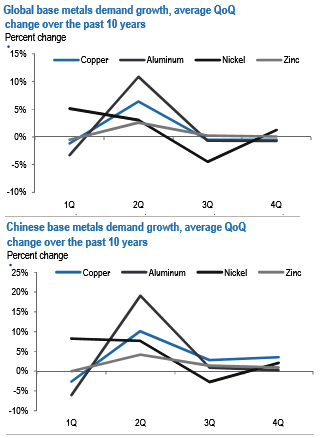

Over the past 10 years, quarterly data show that on average global demand across the base metals we cover has increased between 2.5% and 11% QoQ in the second quarter (refer above chart). With the exception of nickel, average QoQ demand growth in 2Q is by far the strongest of any quarter, particularly for aluminum and copper at 6% and 11% QoQ, respectively.

As with many dynamics in industrial metals, seasonality in global demand (weak Q1 followed by a strong Q2) has been increasingly shaped by China, given it accounts for nearly half of all metals demand.

More specifically, as the Chinese New Year holiday either falls in January or February, Chinese demand seasonality is characterized by very soft demand in 1Q followed by a stark incremental pickup in industrial metals activity in 2Q (refer above chart).

That being said, while ex-China demand follows a different seasonal pattern overall—generally stronger quarterly growth in 1Q than China with weaker growth in 3Q and 4Q—average QoQ demand growth for copper, aluminum, and zinc over the last 10years is still the strongest in 2Q outside of China as well (refer above chart).

As you can see from the exhibits, the one exception is nickel, which generally exhibits the strongest quarterly demand growth in 1Qs and the weakest in 3Qs due to the operational seasonality of stainless steel mills.

Beginning in 2Q, higher demand typically leads to a seasonal turnover in Chinese inventories Given the annual reawakening of Chinese metals demand following the January or February New Year holidays, it should come as little surprise that Chinese industrial metals inventories typically peak in March and draw through at least September.

Copper and aluminum stocks have pretty closely followed this script so far in 2017. More specifically, after increasing by more than 275 kmt so far this year, Chinese bonded and SHFE copper inventories combined are currently around 960 kmt, slightly higher than the 2012-2016 average for March.

Based on recent history, as demand picks up next quarter we expect stocks to begin drawing in April and continue to move lower through 3Q until they trough around 250 kmt lower, according to the five-year average (refer above chart).

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential