Writing a USD/JPY call ladder proves to be profitable irrespective of upswings or downswings as stated earlier.

To execute the short call ladder strategy the positions go this way,

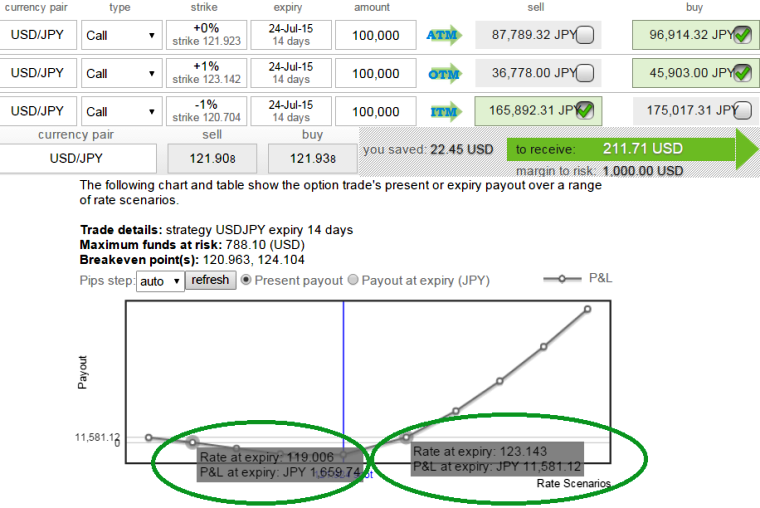

The hedger has to short an in-the-money call, simultaneously buy an at-the-money call and buy another higher strike out-of-the-money call of the same expiration date.

This bear call ladder may prove to be infinite returns and restricted risk strategy in options trading that is employed when the options trader reckons that the underlying currency will experience significant volatility in the near term.

Therefore, the recommendation would be, buy 15D At-The-Money 0.50 delta call and buy another 1M (1%) Out-Of-The-Money 0.35 delta call, simultaneously sell 7D (-1%) In-The-Money call option with positive theta.

As shown in the diagrammatic representation, the strategy should be constructed in such a way that it has to serve profitability and yield payoffs as the underlying exchange rate fluctuates either way. The positions shown in the diagram is for demonstrate purpose only, however everything remains same except reduce time frame for maturity on short sides. We can observe how the potential payoffs at expiry when exchange rate fluctuates on either side.

Maximum returns for the short call ladder strategy is limited if the underlying movement in currency goes down. In this scenario, maximum profit is limited to the initial credit received since all the long and short calls will expire worthless.

However, if the underlying exchange price rallies explosively, potential profit is unlimited due to the extra long call. So, thereby we can block returns on either side of the directions.

FxWirePro: Continue with writing USD/JPY call ladder for hedging in potential downtrend

Friday, July 10, 2015 7:07 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand