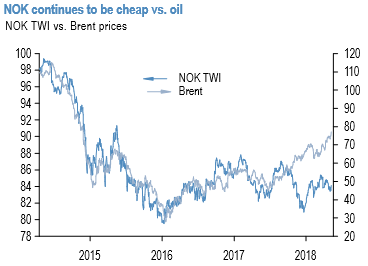

NOK valuations are still cheap with the currency still substantially lagging oil (refer 1st chart). The latest decoupling with oil has come amid deterioration in risk sentiment which we have been flagging as a risk for both Scandi currencies given that they have among the highest beta in G10 to equities.

US Treasury yields moved up modestly yesterday after new data provided further confirmation of buoyant US economic growth. However, the US dollar slipped against both the euro and sterling. Given today’s light data calendar markets are likely to look further ahead. This weekend’s G7 summit is coming into focus and markets will be looking for further indications on the state of global trade relations.

For active delta-hedgers, the current tightness of the USDNOK – EURUSD risk-reversal spread sets up good entry levels into a convex RV (refer 2nd chart) that has a solid track record of performing through the EU debt crisis years even when EURUSD was the epicenter of the crisis.

Ostensibly, the relative illiquidity/more frequent jumps in NOK contribute to higher delivered vols than in the more liquid EUR, which is why such spread trades are better installed in shorter, gamma heavy expiries than in longer ones. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -28 levels (mildly bearish), while hourly USD spot index was at 12 (neutral) while articulating at 07:04 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise