From last 6 weeks, GBPNZD remains stuck in a 1.80 – 1.7380 range.

We still foresee the major downtrend likely to resume and evidence further slumps ahead as the approach of the March 2017 Brexit deadline, Supreme Court findings and end-year survey and hard data are likely to attune markets to harsh Brexit realities.

In a medium term perspective, GBPNZD has further downside potential, and there’s potential for all-time lows again.

The Brexit-related dangers for the UK economy beyond initial confidence are yet to develop, and the scale and scope of BoE’s easing would cap GBP.

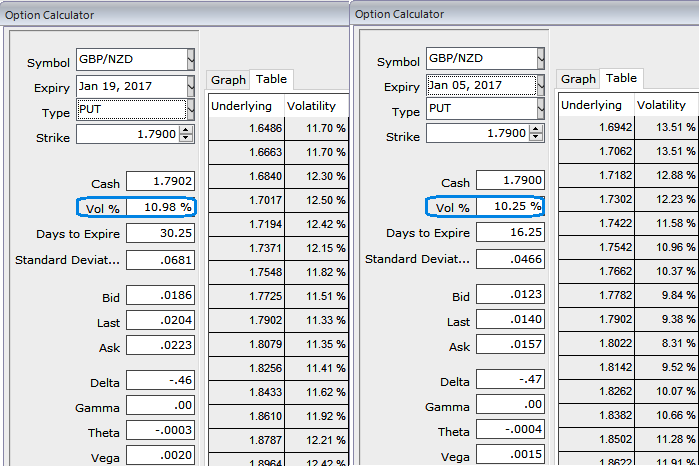

ATM IVs of this pair is trading 11% for 2w and 1m tenors as the sideway trend likely to persist.

The long put butterfly spread is advocated on speculative grounds that carries the limited returns and the limited risk. The strategy is taken when the options trader thinks that the underlying spot FX would not spike or drop much dramatically on expiration.

Three distinctive strikes are involved in this spread and it is constructed by buying one lower striking put, writing two at-the-money puts and buying another higher striking put for a net debit.

The execution: Buy (1%) 1m in the money put option, short 2 lots of 2w at the money put options, simultaneously; buy one more (1%) 1m out of the money put option.

The maximum return for the long put butterfly is achievable when the GBPNZD spot remains unchanged as stated in above range at expiration. At this price, only the highest striking put expires in the money.

The maximum loss for the strategy is limited to the extent of initial debit taken to enter the trade plus commissions.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts