RBNZ is all set for its monetary policy this week for OCR review that may disappoint NZD-bears. On a broader perspective, OCR reviews that are scheduled on this Wednesday, which may disappoint NZD bears with unchanged guidance (developments since the Feb MPS have been roughly neutral). On Thursday, we get to hear from RBNZ Gov. Orr about the new monetary policy regime.

NZDJPY has halted around 76.553 several times amid stalled global equity markets.

The medium-term perspective: We have watered down our bearish outlook, now only targeting 73 by the year-end. A significant risk to Japan’s economic outlook is that China stimulus is insufficient.

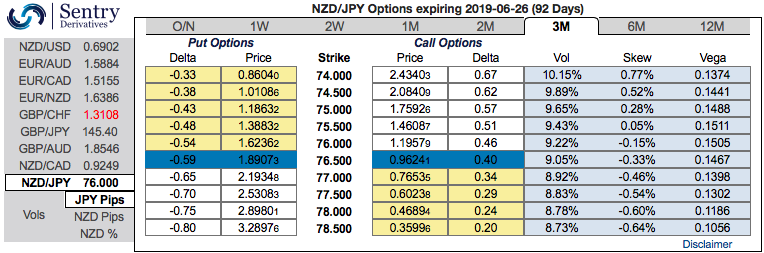

OTC Updates and Options Strategy: To substantiate above bearish stance, the 3m positively skewed implied volatility indicates the hedging sentiments for the lingering bearish risks. Bids are for OTM puts up to 74.000 levels.

As a result, we construct suitable options strategy favoring slightly on the bearish side. Initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

Well, a higher (absolute) Delta value is desirable on the long leg in the above-stated strategy. Whereas, the Theta is positive on the short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce the cost of hedging with time decay advantage on the short leg, while delta longs likely to arrest potential bearish risks. Courtesy: Westpac & Sentrix

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 54 levels (which is bullish), JPY is at 98 (bullish) while articulating (at 07:24 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady