In just last nine and half months, GBPCAD has declined from the highs of 2.0972 to the current 1.8650 levels, (i.e. almost 11.07%), we think this itself is suffice to be convinced of major downtrend.

The only key economic data to be published for today is the March industrial production numbers in UK, set to show a reasonable bounce from previous -1.1% versus forecasts at 0.4%.

However, firm sentiment deteriorated in UK noticeably in April and is likely to worsen further as the EU referendum draws nearer, supporting our expectation of zero growth in Q2 16.

Don’t dare to forget the recent UK PMIs for all sectors that have deteriorated considerably.

Manufacturing PMI – Decline from previous flash of 50.7 to the current 49.2.

Construction PMI – Decline from previous flash of 54.2 to the current 52.0.

Service PMI – Decline from previous prints of 53.7 to the current 52.3.

Preliminary GDP (q/q) has been narrowed down to 0.4% from previous 0.6%.

These numbers are actual the leading indicators of economic health – indicates as to how the businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

In addition, we continue to expect the BoE’s bank rate is likely to be unchanged in this week’s monetary policy. We think the Committee is likely to continue to look through EU referendum uncertainties.

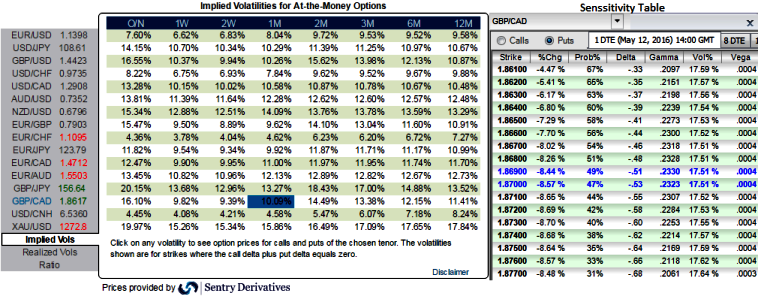

Elsewhere, in OTC markets, ATM IVs seem to be quite poised to factor in the weakness of this pair as we could see marginal increase in IVs of 1W (9.82%) and 1M tenors (10.09%).

As a result, we recommend capitalizing on the sustainable IV factor by employing ITM short puts as the central bank's decision was in line with previous market's expectations and for now likely to remain same.

ATM longs to construct short term back spreads that is likely to fetch positive cash flows as per the indications by sensitivity table.

When trying to assess how a spread may perform, look at the spreads of deeper in-the-money options for an indication of relative option prices. (For a demonstrated purpose we’ve used 1% ITM instruments, in real times use longer expiries on ATM longs.

So, keeping all these attributes in mind, here goes the strategy, go long in 1M 2W 2 lots of ATM -0.50 delta put, and in 1M 2W (0.5%) OTM -0.35 delta puts, while shorting 1 lot of ATM put and (0.5%) OTM put with both expiries of 1 week.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary