The euro crosses have eased only briefly in the recent past ahead of ECB’s monetary policy today as the news report that the European Central Bank would probably lower its projections significantly, justifying another round of long term tenders to the banking sector. We run you through EURJPY bearish scenarios, OTC updates, and options strategy ahead of the monetary policy.

Bearish EURJPY Scenarios:

1) The global investors’ risk aversion heightens significantly,

2) Euro growth gets stuck below 2% and ECB hikes only in 2020;

3) The US starts vehemently criticizing Japan’s trade surplus against the US.

4) The extended political protests in France, a populist tide at the European parliamentary elections in May.

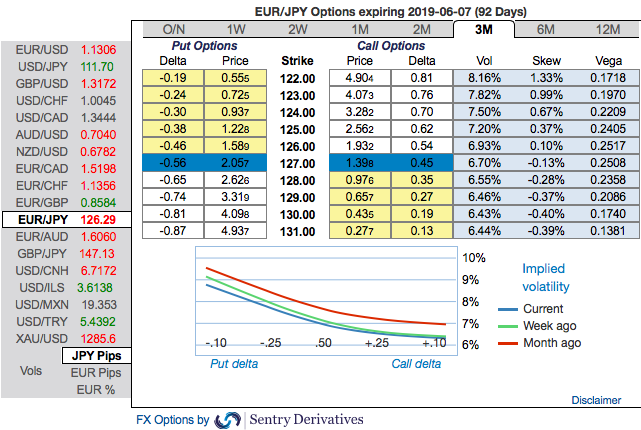

Hedging skewness: Let’s quickly glance at the positively skewed IVs of 3m tenors that are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 122.50 levels so that OTM instruments would expire in-the-money.

Risk reversals (RRs) Substantiate Skews: Most importantly, to substantiate the above indications, bearish neutral risk reversal numbers of all euro crosses except EURGBP (especially EURJPY) across all tenors are also substantiating bearish risks in the long run amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Options Trade Recommendation (EURJPY): Contemplating all the above factors, we advocate buying 3m EURJPY (1%) ITM -0.69 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money put option with a very strong delta will move in tandem with the underlying. Source: Sentrix, JPM, and Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -34 levels (which is mildly bullish), while hourly JPY spot index was at 97 (bullish) while articulating at (07:51 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data