Asia focus: 2017 growth drivers: With GDP growth for the final quarter of 2016 rolling in from around the region. As per the JPM’s projections, EM Asia GDP grew 5.8% in 2016, in line with their expectations at the beginning of last year (refer above nutshell). Looking ahead, the forecasts go another tick down in regional growth to 5.7% in 2017, the second year of sub 6.0% growth since 2001.

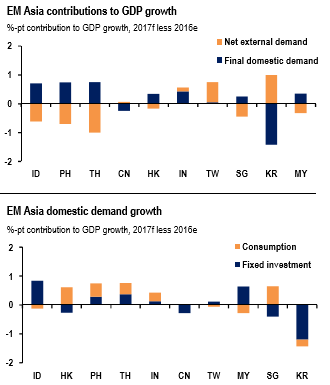

The expected slowing in the regional heavyweight China weighs down 2017 EM Asia growth forecasts, as its solid domestic demand conditions in 2016, supported by a robust housing market, likely will soften this year. The recovery in consumption in India, due to the fading impact of demonetization, should partially offset the slowing in China (refer above diagram).

Outside of China and India, domestic demand conditions remain positive this year, except in Korea, where political uncertainty and tight fiscal policy likely will drag on investment growth. A stronger tech cycle likely will contribute more to growth in Korea and Taiwan in 2017 than in 2016. In ASEAN, fiscal spending should keep domestic demand firm, while consumption remains more mixed (refer above diagram).

Our long dollar risk is selective and focused on low yielders (except CNH) and mostly via options.

Stay long USDKRW via 1x2 call spread: Good entry point with 61.8% retracement level from the September low to December high coming in around 1136. 1x2 structure improves max leverage to 9 times from 3 times in a 1x1.

Stay long USDSGD via a one-touch: Worried about French elections and EUR parity? SGD 3m implied vol about 40% cheaper than EUR vol.

Stay long USDCNH via a 1y seagull: Expensive to bet against the CNH. Seagull provides upside exposure that is cheapened significantly by selling expensive 1y vol.

Initiate long USDTWD: Tactical position to fade YTD strength in TWD; could face more formidable support above the May 2015 low (30.39).

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains