The speed of the correction in EM FX has surprised us, but we remain cautiously pro-carry in our region, given supportive valuations.

Among EM currencies, MXN vs. RUB is an interesting skew pair trade to consider.

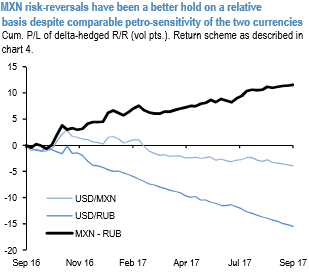

Neither has been individually profitable to hold from the long side, but the long/short RV has been a strong performer (refer above chart) and is relatively immune to gyrations in oil prices given the comparable petro-sensitivity of the two legs.

Current skew levels are favorable (3M 25D MXN RR @ 1.75 mid, RUB RR 3.1 mid; RR/ATM ratios 0.16 and 0.25 respectively), and JPM house views on the two currencies are aligned with the direction of the spread (U/W Mexico on NAFTA and heavy positioning grounds; O/W RUB on cheap valuations, carry and relatively clean spec positions).

The present combination of RUB FX and oil prices is quite favorable for the budget – RUB 3200- 3400 for Brent over the past week, i.e. on the high end of this year’s range – even if the significance of the gauge has diminished with the new budgetary rule in place.

Directional investors not given to active delta-hedging could consider long USD puts/RUB calls vs. short USD puts/MXN calls as a low management version of the skew RV. Courtesy: JPM

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed