The Aussie remains somewhat pricey compared to short-term fair value estimates, as yield differentials along the curve move steadily in the US dollar’s favor. This weight on AUD should only increase over the next year or two. Shorter-term though, markets are already priced for a Fed hike this month and no change from the RBA for many months.

Moreover, commodity prices have emerged from Asia’s Lunar New Year holidays still holding most of the late 2017 gains. Optimism over global growth remains intact though US-driven trade tensions pose downside risks to global trade volumes and AUD. We look for 0.78 end-Mar, 0.77 end-Jun, and 0.74 end-Dec.

Elsewhere, the US dollar is yet to establish an uptrend, which means further gains in NZDUSD beyond 0.74 are possible during the month ahead. Further out, though, we are bearish. The NZ government is also reviewing the RBNZ's mandate with the intention of inserting "maximum employment" as a second mandate alongside price stability and moving to a committee structure for monetary policymaking. The RBNZ is therefore expected to stay on the sidelines through 2018 in the face of the institutional changes and countervailing fiscal effects. The NZ-US interest rate advantage is rapidly shrinking and should eventually weigh, pushing NZDUSD towards 0.69 by mid-year.

Options trades:

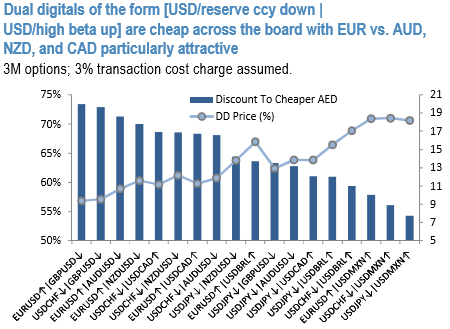

Dual digitals of the form (USD/reserve FX down, USD/high beta up, pricing (refer above chart) is particularly attractive in EUR vs AUD and EUR vs NZD at > 8x gearing on 3M 1% OTMS options (after 3% b/o charge).

1% OTMS strikes, set on both legs, should be a modest hurdle to overcome in case of adverse trade developments, but even setting a high beta strike at ATMS to give more room to the so far resilient high beta FX would only lift nominal option prices into the to mid-teens.

- 3M EURUSD > 1% OTMS, AUDUSD < 1.0% OTMS dual digital costs 10.6%

- 3M EURUSD > 1% OTMS, NZDUSD < 1.0% OTMS dual digital costs 10.7%.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios