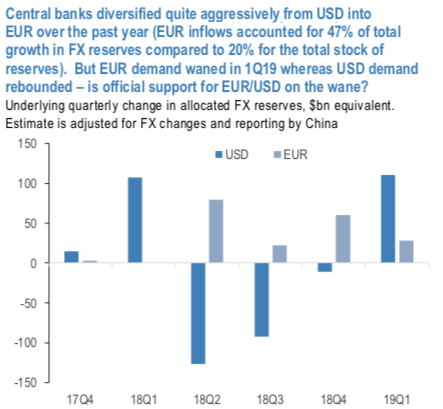

ECB has continued to maintain status quo in its yesterday’s monetary policy. The European central bank is no longer as passive about the economy and lack of progress on inflation as it was before Draghi’s activist Sintra speech. The ECB’s increased urgency to act could help to restore the missing link between economic performance and the currency, to the detriment of EUR. 2) Central bank demand for EUR could well be moderating and USD demand on the increase again, to judge from the IMF's 1Q’19 COFER data on reserve allocations (refer 1st chart).

We don’t expect a resumption of ECB QE at this stage (our economists expect a change in forward guidance next week followed by a 10bp cut in September) but the rates market discounts perhaps a 50-60% chance that QE will be restarted. What effect might QEII have on EUR? The prelude to QEI in early 2015 was of course punctuated by a 25% drop in EURUSD from its peak in mid-2014 (refer 2nd chart). Not all of that drop can be directly ascribed to QE (there was the not insignificant small matter of Greece to contend with).

Nevertheless, a recent ECB paper estimates that the €2.6tn program depressed EURUSD by around 12% in total through its various channels (Does a big bazooka matter? Central bank balance-sheet policies and exchange rates, ECB working paper no.2197). This equates to 0.5% for every €100bn. Now the law of diminishing returns may apply to unconventional policy measures, especially as the signaling channel will be less effective now that the market expects policy rates to stay at a current or lower level until mid-2022. But even so, it would be a stretch to assume that QEII, or indeed even the mere expectation of QEII, would be a non- event for the currency.

Bearish EURUSD scenarios:

1) ECB goes all-in with rates cuts, tiering and QE.

2) Trump proceeds with tariffs on Euro car imports.

3) A no-deal Brexit.

Bullish EURUSD scenarios:

1) Trump sanctions unilateral FX intervention to weaken USD.

2) A US-China peace treaty on trade.

3) Euro-area economy rebounds to a sustained 1.5%+ growth rate.

4) A re-acceleration of CB demand for EUR.

OTC Updates:

The FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiments remain intact.

Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above nutshell, 3m positively skewed IVs are stretched on either side (equal interest in both OTM call and OTM puts) that signifies hedging sentiments for both upside and downside risks.

To substantiate these indications, a positive shift in short-term and bearish neutral RRs (risk reversals) across long-term tenors, which is in line with the above-stated bearish scenarios.

Options Strategies:

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write a (1%) out of the money put option of 2w tenors.

Alternatively, the dubious bulls but with hedging grounds can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, Saxo & JPM

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist